UK Freelancer Accountancy Tool

👋 Too Busy Working to Worry About Tax?

Meet the UK Freelance Accountancy Manager, your simple, secure, and dedicated digital tool for effortlessly organising your self-employment finances. Stop juggling spreadsheets and start streamlining your invoices, expenses, and tax estimations in one private dashboard.

Logged in?

📊 Access the tool – Fully secure and available only for the subscribed UK freelancers.

Not subscribed yet?

👉 Get started today for a tiny annual subscription and take control of your financial year!

The Importance of the Right Tool for UK Freelancers

As a self-employed professional, your focus should be on your craft, not complex paperwork. HMRC requires meticulous record-keeping for both Self Assessment (Income Tax and National Insurance) and VAT Returns. Errors lead to penalties, and poor organisation leads to missed deadlines and overpayment.

Our tool is specifically engineered for the UK tax year (6 April – 5 April) and designed to give you instant, accurate figures needed for filing, saving you time and stress at deadline crunch time.

How the Accountancy Manager Tool Works

The tool is divided into intuitive tabs, allowing you to manage your entire financial journey securely:

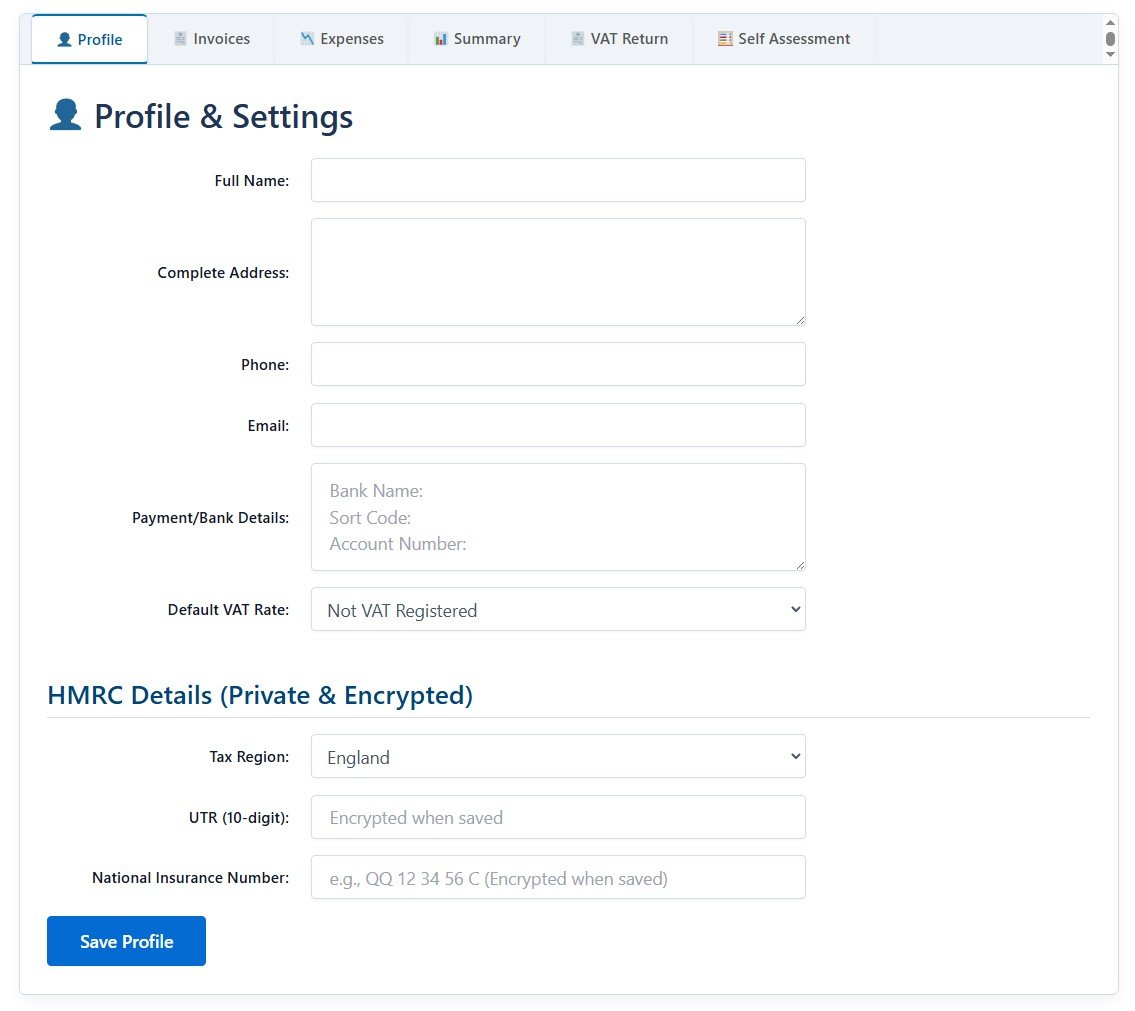

- 👤 Profile & Settings: Securely store your essential business details, bank information, and private HMRC credentials (UTR, NIN) using a data-separated, encrypted system. You only need to set this up once.

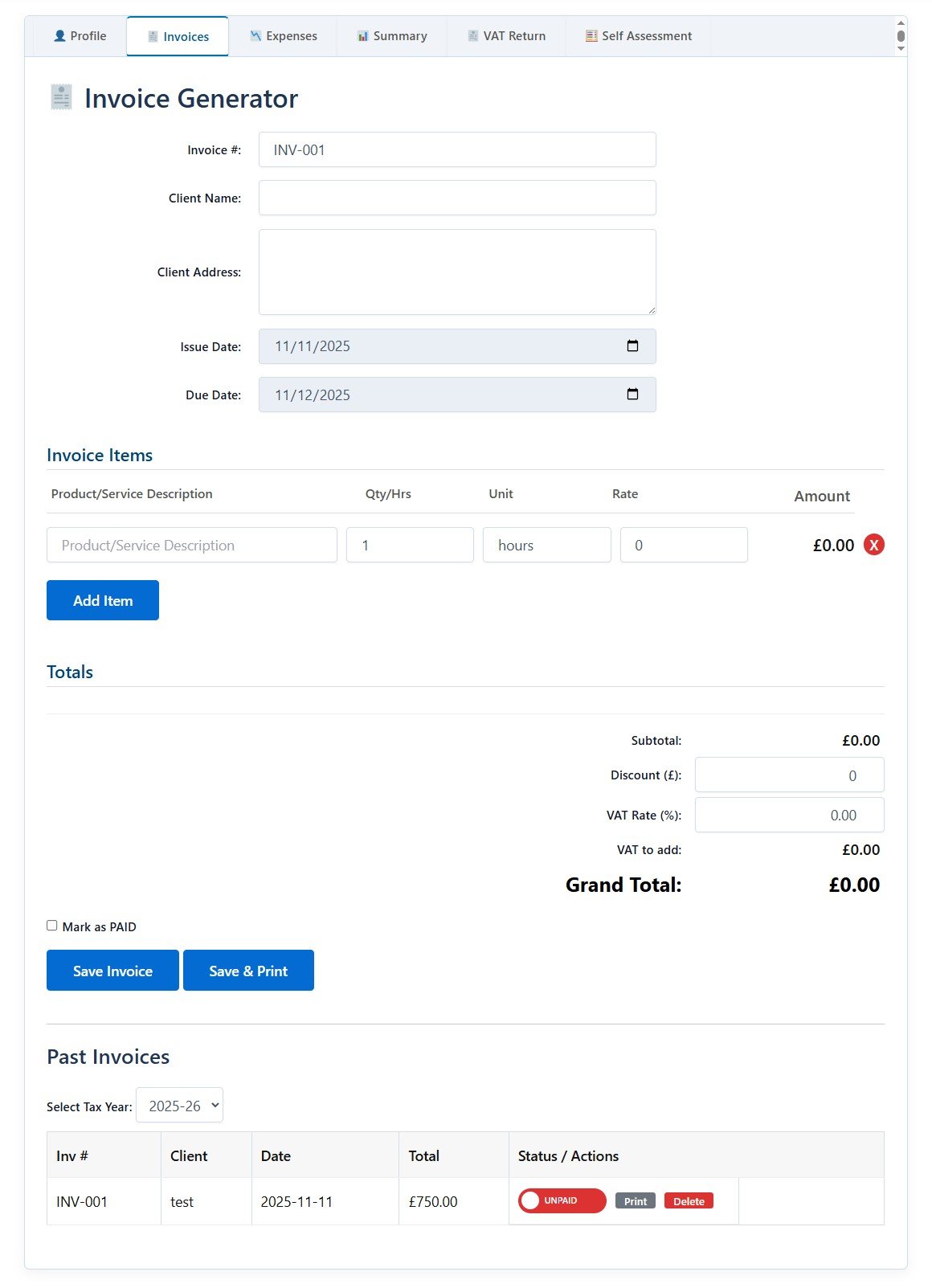

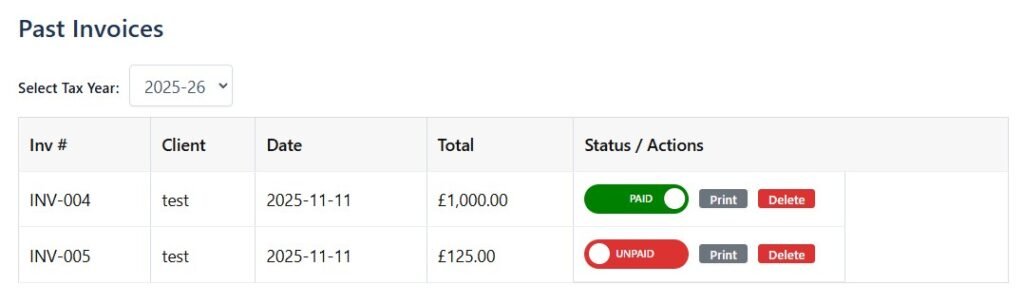

- 🧾 Invoices: Create and track professional invoices. The tool automatically calculates Subtotals, Discounts, and VAT (if applicable). It tracks payment status (PAID vs. UNPAID) which is critical for cash basis Self Assessment.

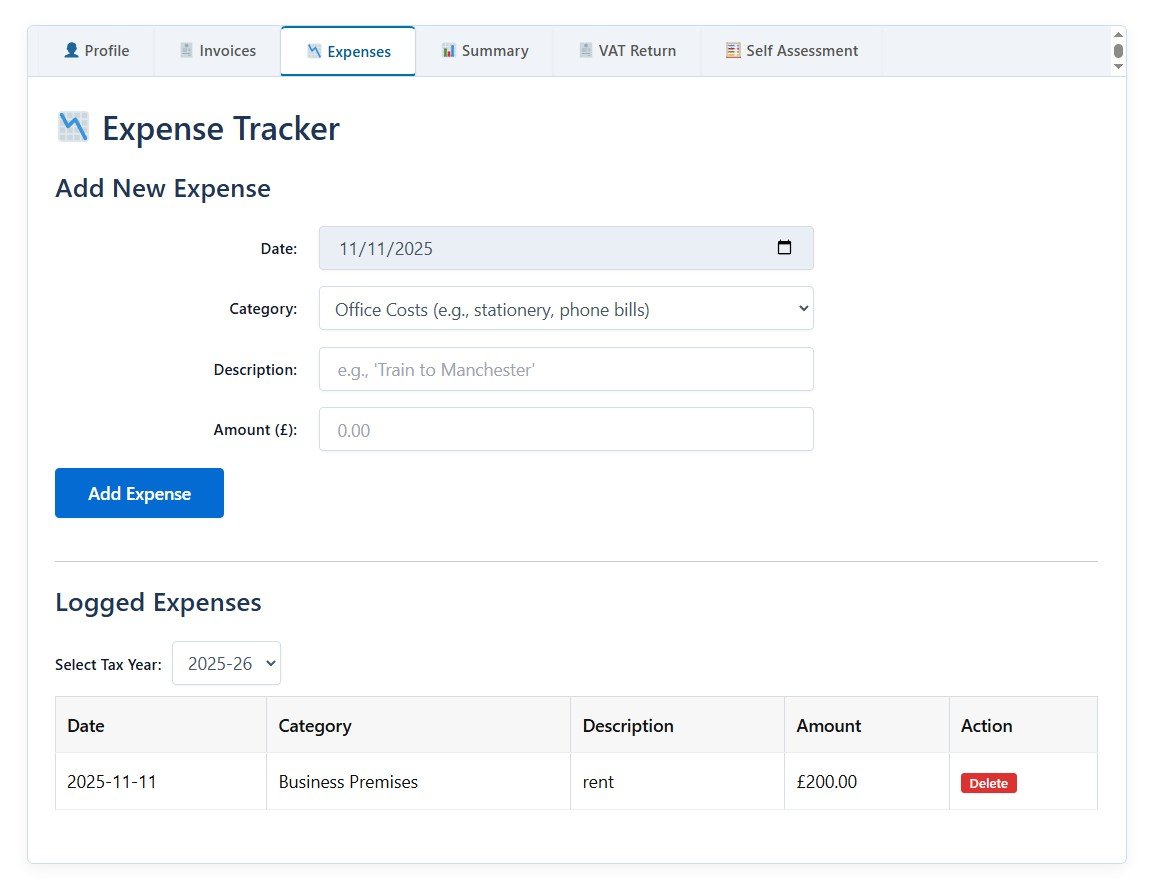

- 📉 Expenses: Log every business expense, categorize it based on HMRC guidance (Office Costs, Travel, etc.), and maintain a clear digital trail, ensuring you maximize your allowable deductions.

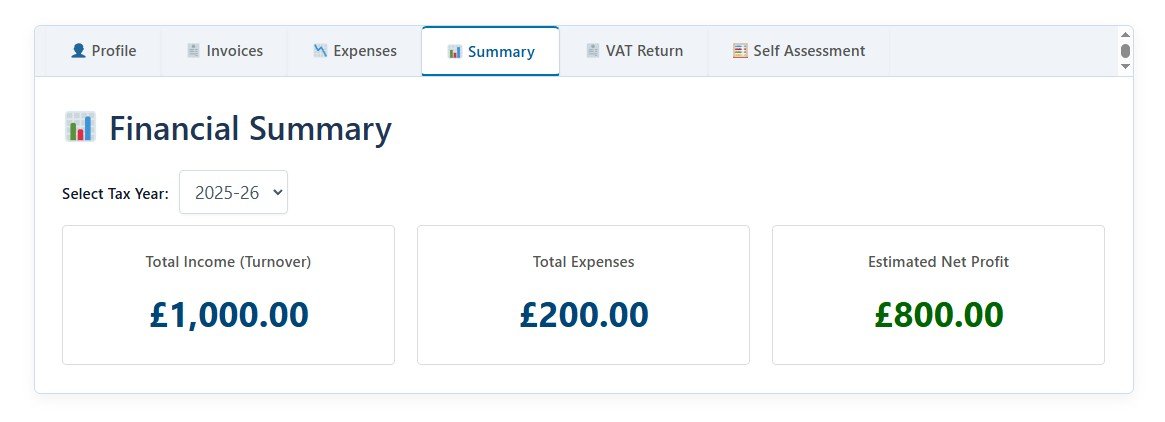

- 📊 Summary: Get a live, snapshot view of your financial health for the selected tax year: Total Income (Turnover), Total Expenses, and Estimated Net Profit.

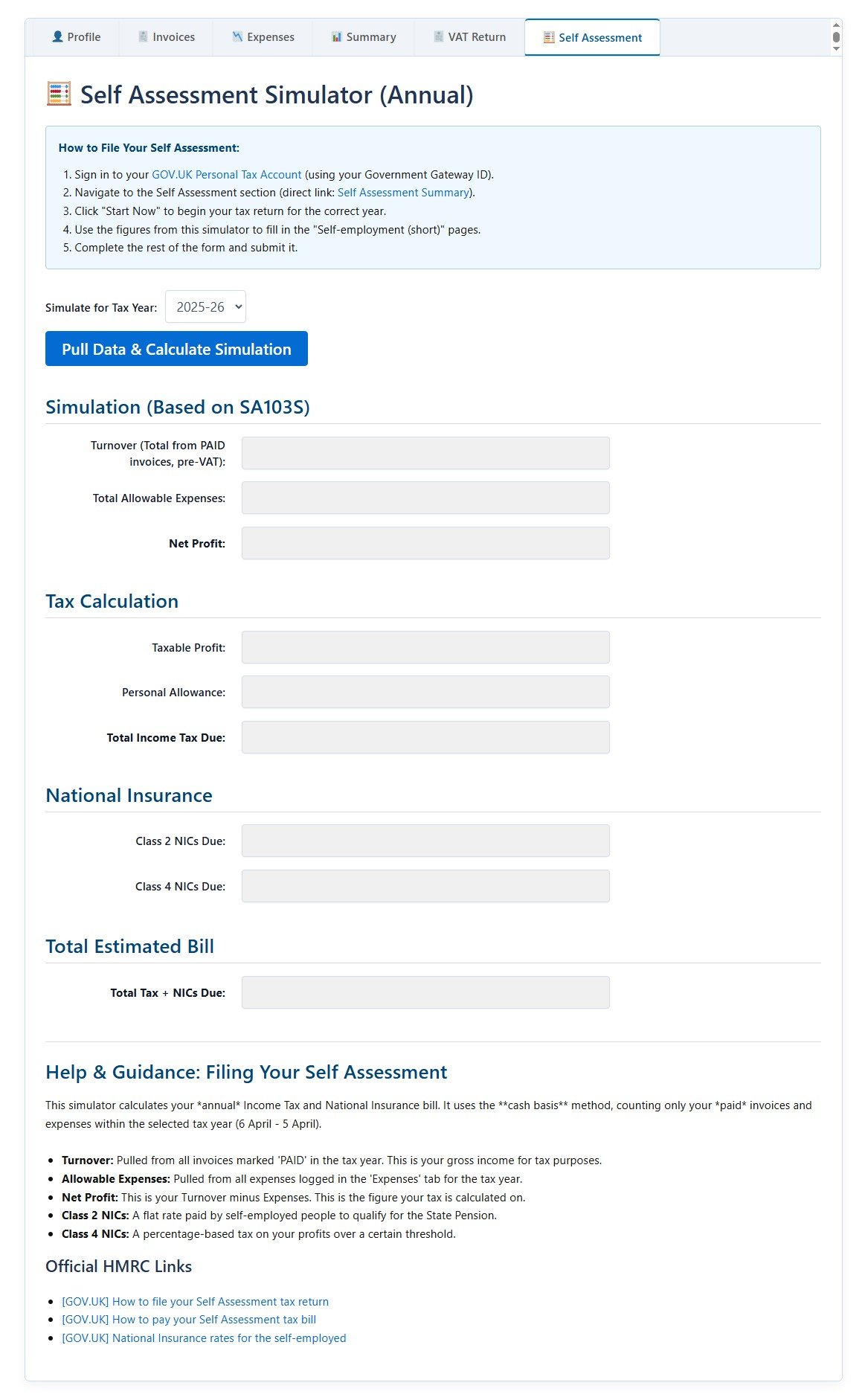

- 🧮 Self Assessment Simulator: Generates key figures (Turnover, Expenses, Profit) based on paid invoices to simulate your annual Income Tax and National Insurance liabilities, giving you the numbers you need for your tax return form.

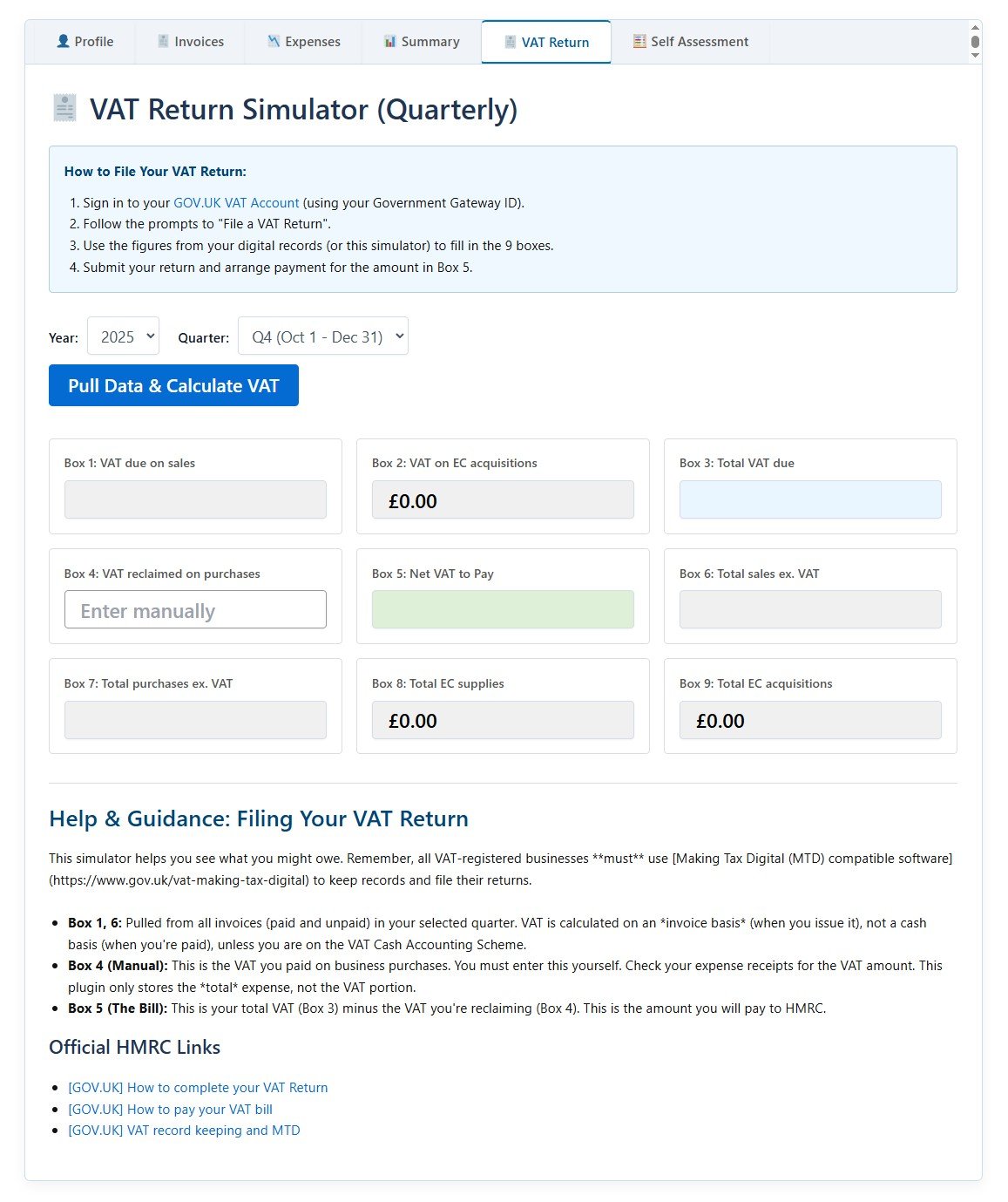

- 🧾 VAT Return Simulator: If you are VAT registered, this tool pulls quarterly sales (Box 6) and VAT due (Box 1) from your invoices, simplifying the quarterly filing process.

🔒 Secure, Private, and Dedicated Access

This tool operates as a secure, multi-user system.

- Your Data is Private: Every piece of financial data (invoices, expenses, profile details) is uniquely tagged to your personal user account.

- Zero Visibility: No other user of the service, even those with the same “Paid Member” role, can ever view your financial records. When you log in, you only access your own private, encrypted dashboard.

👉 Get started today for a tiny annual subscription and take control of your financial year!

Mastering the UK Freelancer Accountancy Manager

Here is the step-by-step workflow for managing your financial year using the tool, breaking down the function of each tab and its required action:

1. 👤 Profile & Settings (The Foundation)

This tab is the foundation of your business records and only needs updating when your details change. Enter your current, complete Full Name, Address, Phone, and Email details. For the Payment/Bank Details, input your banking information (Bank Name, Sort Code, Account Number) exactly as you wish clients to pay you; this information will appear on generated invoices. Set your Default VAT Rate to 20% if you are VAT registered, otherwise leave it at 0.00%. Finally, select your Tax Region (e.g., Scotland) so the Self Assessment Simulator can apply the correct Income Tax bands, and input your encrypted UTR and NIN. Click Save Profile to lock in your details.

2. 🧾 Invoices (Tracking Income)

Use this tab every time you bill a client. Fill in the client’s name and address and set clear Issue and Due dates. For Invoice Items, use the Add Item button to list the Description of service, Quantity/Hours, and Unit Rate; the totals will calculate automatically. Enter any Discount (£) and ensure the VAT Rate is correct for this client. The most CRITICAL step for tax accuracy is the Mark as PAID Checkbox; you must only check this box once the money has actually arrived in your bank account, as this status moves the income into the “Profit” calculation used by the simulators. You can review past invoices in the table below and change the payment status using the Toggle Paid switch.

REMEMBER to tick the invoices for which you received the money!

Only the paid invoices will be considered incomes.

3. 📉 Expenses (Tracking Deductions)

Use this tab immediately after making a business purchase. Log the Date, Description, and Amount (the total cost shown on your receipt). Crucially, assign the expense to an HMRC Allowable Category (e.g., Office, Travel, Legal) as this classification is essential for your Self Assessment calculation. The logged expenses are automatically filtered by the Select Tax Year dropdown, allowing you to quickly review total expenditure for any 6 April – 5 April period. Click Add Expense to save the entry.

4. 📊 Summary (Quick Health Check)

This is a read-only dashboard that provides an instant snapshot of your year’s performance based on your inputs. Total Income (Turnover) is the sum of all paid invoices in the selected tax year. Total Expenses is the sum of all logged expenses in the period. The Estimated Net Profit is the key figure (Total Income minus Total Expenses) upon which your Income Tax will be calculated. Use the Select Tax Year dropdown to generate a quick, high-level financial overview for any period.

5. 🧮 Self Assessment Simulator (Annual Tax Return Filing Prep)

Use this tab to prepare for the 31 January filing deadline. The simulator pulls all your relevant financial data and applies tax logic. Turnover, Total Allowable Expenses, and Net Profit are displayed as the core figures required for the HMRC SA103S form. The tool calculates your Total Tax + NICs Due by automatically factoring in your Personal Allowance, Income Tax bands based on your region, and the correct Class 2 and Class 4 National Insurance Contributions. Use this final calculated figure to budget and pay your Self Assessment tax bill.

6. 🧾 VAT Return Simulator (Quarterly Filing Prep)

If you are VAT registered, use this quarterly. The simulator populates the main figures required for your VAT return: Box 1 (VAT due on sales) from collected VAT on issued invoices, and Box 6 (Total sales ex. VAT) from the net value of those sales. Box 7 (Total purchases ex. VAT) reflects your total expenses for the quarter. CRITICALLY, you must manually enter the exact VAT amount you are reclaiming from your purchase receipts into Box 4 (VAT reclaimed), as the tool cannot calculate this automatically. The simulator then calculates Box 5 (Net VAT to Pay). Use the final Box 1, Box 4, and Box 5 figures to submit your quarterly VAT return.

Important: Best Practices & Legal Obligations

The UK Freelance Accountancy Manager is a powerful organizational tool, but it does NOT file your taxes for you. You remain legally responsible for submitting your own documentation to HMRC.

Your Filing Checklist (Links to GOV.UK):

- Self Assessment (SA): How to File your SA Tax Return

- Personal Tax Account: Personal Tax Account

- Self Assessment Summary: SA Summary Page

- VAT Return: VAT Account Sign-In

- MTD Compliance: Making Tax Digital for VAT

⚖️ Legal Guidance & Organizational Support

This tool simplifies HMRC compliance by ensuring your records are accurate and categorized. To keep your financial affairs robust and audit-ready, please observe these core HMRC best practices:

1. Record-Keeping Requirements

- Keep Your Records: You must keep records of all sales, income, and business expenses for at least five years after the 31 January submission deadline of the relevant tax year.

- Proof of Expense: For every expense entered into the tool, you must retain the original documentation (receipt, invoice, bank statement) as proof. HMRC can request these during an enquiry.

- Business vs. Personal: Strictly separate your business finances from personal finances. While the tool tracks them digitally, having a dedicated business bank account simplifies compliance.

2. Claiming Allowable Expenses

- The ‘Wholly and Exclusively’ Test: An expense is only “allowable” (deductible) if it was incurred wholly and exclusively for the purpose of your trade. If an expense has a dual purpose (e.g., clothing that could be worn socially), it is usually not allowable.

- The Simulator’s Role: Use the Expenses tab to categorize costs according to HMRC categories (e.g., travel, office costs). The tool then factors these into your profit calculation for the Self Assessment Simulator.

3. Seeking Professional Help

- Appointing an Agent: If you find the Self Assessment process overwhelming, you are legally permitted to appoint an agent (like an accountant or tax adviser) to manage your tax affairs. This agent can submit your return on your behalf.

- HMRC Extra Support: If your health or personal circumstances make it difficult to deal with HMRC, they have an Extra Support Team that can provide additional assistance.

👉 Get started today for a tiny annual subscription and take control of your financial year!

Frequently Asked Questions (FAQ)

What is the UK Freelance Accountancy Tool?

It is a dedicated, web-based tool designed specifically for UK sole traders and freelancers to track, manage, and calculate their income, expenses, and tax liabilities. It provides the exact figures you need to fill out your annual Self Assessment and quarterly VAT returns quickly and accurately.

Why is a good financial organization so important for freelancers?

Good organization is vital because HMRC places the legal burden of proof entirely on the self-employed individual. Keeping organized records in one system ensures you: Avoid Penalties for late or inaccurate filings; Maximize Tax Savings by claiming all legitimate allowable expenses; Simplify Filing by providing instant, calculated figures for your annual tax return.

Who can benefit from this accountancy tool?

This accountancy tool is designed for UK-based individual sole traders, freelancers, contractors, and side-hustlers who use the Cash Basis of accounting and need a simple, centralized system for invoicing and expense tracking.

How much does the UK Freelance Accountancy Tool cost?

We offer access to the full suite of tools for just £10 per year. This provides you with year-round access, secure data storage, and the latest UK tax year updates.

Is my financial data secure?

Yes. The application is built on the secure WordPress platform, and critically, all sensitive user data (including profile details and financial records) is protected by a multi-user system where only your unique user ID can access your specific data. It is completely private and separate from other members.

Does this accountancy tool replace my Accountant?

No, this tool does not replace a qualified accountant. It is designed to replace manual spreadsheets and organization apps. An accountant can offer personalized advice on complex financial situations, pensions, investments, and capital allowances that go beyond the scope of this management tool.

Does this automatically file my tax return with HMRC?

No. This tool is a powerful calculator and organizer, but it does not submit data to HMRC. You must still log into your Personal Tax Account and manually input the calculated figures from the Self Assessment Simulator and VAT Return Simulator into the official GOV.UK forms.

Why the ‘Paid’ status on invoices for the Self Assessment Simulator?

The simulator is based on the Cash Basis of accounting, which is the most common method for freelancers and small businesses. Under the Cash Basis, you only count income when you actually receive the money (when the invoice is marked ‘PAID’) and expenses when you actually pay them. This gives you the most accurate picture for your Self Assessment filing.

👉 Get started today for a tiny annual subscription and take control of your financial year!