|

Getting your Trinity Audio player ready...

|

President Donald Trump has once again imposed new tariffs on Chinese imports, reigniting debates over the economic and geopolitical consequences of protectionist trade policies. This decision, which aligns with his long-standing stance on trade imbalances, aims to bolster domestic industries, reduce dependency on China, and exert pressure on Beijing’s economic practices. However, the effectiveness of such tariffs remains highly contentious, with financial analysts warning of potential repercussions for American businesses, consumers, and global trade stability.

The Economic Rationale Behind the Tariffs

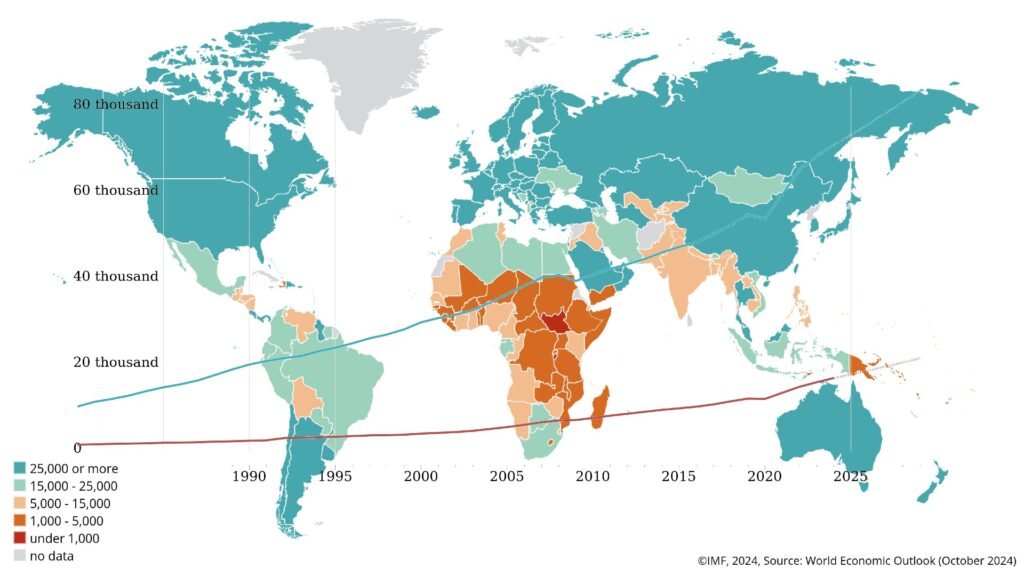

The rationale for imposing tariffs on Chinese goods stems from concerns over unfair trade practices, including intellectual property theft, state subsidies, and an ongoing trade deficit. President Trump and his administration argue that tariffs serve as a strategic tool to level the playing field for American manufacturers and encourage domestic production. By increasing the cost of imported Chinese goods, the administration aims to incentivize companies to relocate supply chains back to the U.S.

However, economic experts warn that such measures may not yield the intended results. Tariffs are ultimately a tax on imports, leading to higher costs for American businesses that rely on Chinese raw materials and components. The downstream effect of these price increases often results in inflationary pressures, which can diminish consumer purchasing power and reduce economic growth.

Financial Market Reactions and Investor Concerns

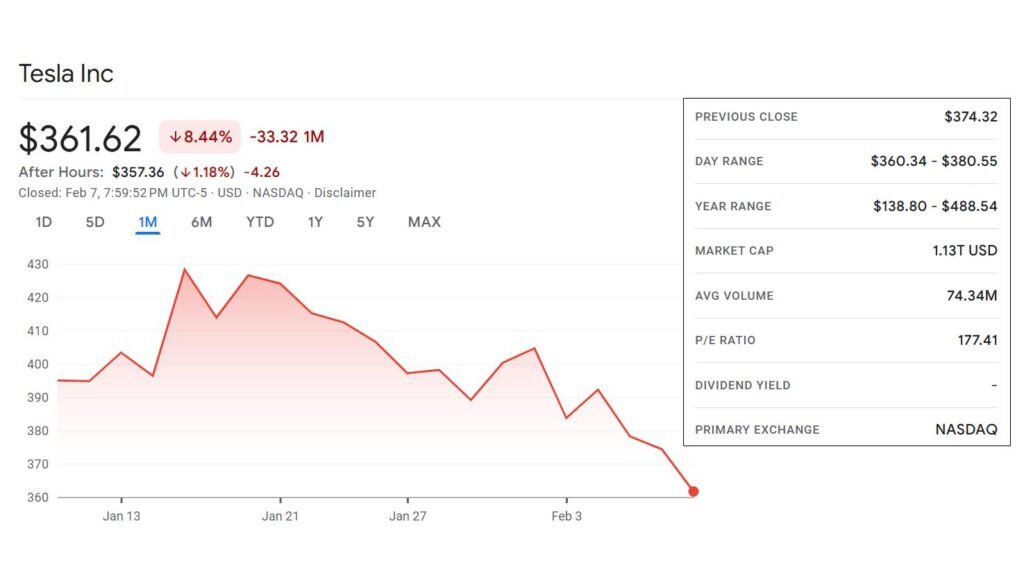

Historically, financial markets have responded negatively to escalating trade tensions between the U.S. and China. The stock market, particularly sectors dependent on global supply chains, often experiences volatility following tariff announcements. The uncertainty surrounding trade policy can deter investment, as businesses struggle to forecast production costs and navigate shifting supply chain dynamics.

Additionally, tariffs could strain multinational corporations that operate within a globally integrated economy. Companies like Apple, Tesla, and major semiconductor manufacturers source significant portions of their components from China. A tariff-induced cost increase would likely be passed onto consumers or lead to margin compressions, both of which could impact stock valuations and investor sentiment.

The Impact on U.S. Consumers and Businesses

While tariffs are designed to protect American industries, they frequently come at a cost to consumers. The increase in import prices is usually transferred to retail prices, affecting everyday goods such as electronics, apparel, and household appliances. For middle- and lower-income households, this translates into reduced disposable income and a potential decline in consumer spending, a key driver of U.S. economic growth.

For businesses, particularly small and medium-sized enterprises (SMEs), higher input costs could lead to reduced competitiveness. Companies that cannot afford to absorb tariff-related expenses might downsize, delay expansion plans, or move production to alternative low-cost regions like Vietnam or Mexico, negating the intended goal of domestic economic revitalization.

China’s Potential Countermeasures

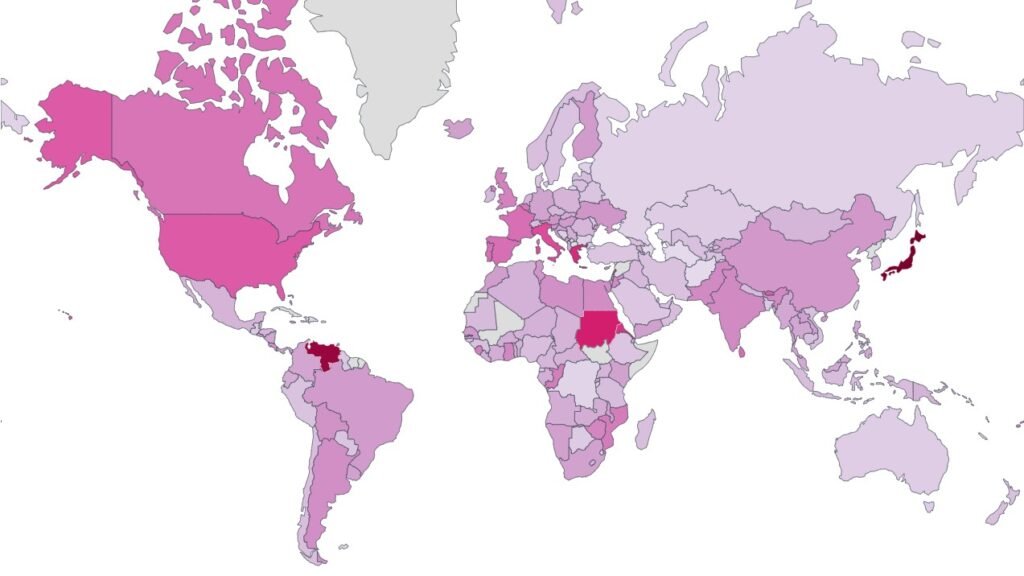

China has historically retaliated against U.S. tariffs with its own set of levies on American exports, targeting key industries such as agriculture, automotive, and technology. Previous trade conflicts saw Beijing imposing tariffs on soybeans, aircraft, and liquefied natural gas (LNG), significantly affecting U.S. farmers and energy exporters. If Trump’s new tariffs escalate into another trade war, China could implement similar countermeasures, further straining economic relations between the two superpowers.

Moreover, China could leverage alternative strategies, including currency devaluation, diversifying its supply chains, or strengthening trade partnerships with other economies such as the European Union and Southeast Asia. This shift could weaken the U.S.’s influence in global trade and potentially diminish the long-term effectiveness of tariff policies.

Alternative Policy Approaches

Instead of tariffs, some economists advocate for alternative strategies to address trade imbalances with China. These include strengthening trade alliances with allies to exert collective pressure on Beijing, enhancing domestic investment in high-tech manufacturing, and negotiating comprehensive trade agreements that establish fair competition standards. Such approaches could mitigate economic risks while achieving the overarching goal of reducing dependency on Chinese imports.

Hey, Trump: Trade War is a Risky Game

President Trump’s decision to impose new tariffs on Chinese imports reflects a continuation of his aggressive trade policies following his return to office in 2025. While intended to strengthen American industry, the economic and financial ramifications remain complex and uncertain. The imposition of tariffs risks higher costs for businesses and consumers, market instability, and retaliatory actions from China. Given the interconnected nature of global trade, a more nuanced approach—balancing economic protectionism with diplomatic negotiations—may be necessary to achieve sustainable long-term benefits. The ultimate outcome of these tariffs will depend on how businesses, consumers, and international trade partners react in the coming months.