|

Getting your Trinity Audio player ready...

|

As cryptocurrencies continue their meteoric rise in both value and popularity, the concept of mining crypto remains a vital, albeit complex, cornerstone of the digital economy. But what exactly is cryptocurrency mining, and how does it work? Today, we dive deep into the mechanics, economics, and realities of digital mining.

What is Cryptocurrency?

A cryptocurrency is a digital or virtual form of money secured by cryptography, making it nearly impossible to counterfeit or double-spend. Unlike traditional currencies issued by governments, cryptocurrencies operate on decentralized networks based on blockchain technology. They allow secure, transparent, and immutable peer-to-peer transactions without the need for intermediaries such as banks or financial institutions. Bitcoin, launched in 2009, was the first cryptocurrency and remains the most influential and valuable in the market today.

What is Crypto Mining?

Crypto mining is the process of validating transactions on blockchain networks and adding them to the public ledger. Miners, equipped with powerful computers, compete to solve complex mathematical puzzles. The first to crack the puzzle earns the right to add the new block of transactions to the blockchain, thereby receiving newly minted cryptocurrency tokens as a reward. Bitcoin mining, for example, offers miners a reward every 10 minutes, with each block reward currently set at 6.25 bitcoins, an amount halving roughly every four years.

The Technology Behind Mining

Cryptocurrency mining is underpinned by cutting-edge technology, involving both specialized hardware and advanced software. Understanding this technological backbone is critical to grasping how mining has evolved into the highly competitive and sophisticated industry we see today.

Hardware

Mining began with basic CPUs, but as competition surged, miners transitioned to more powerful GPUs (Graphics Processing Units), FPGAs (Field Programmable Gate Arrays), and eventually specialized ASICs (Application Specific Integrated Circuits). Today, ASIC miners dominate Bitcoin mining, offering unparalleled processing power and energy efficiency.

Software

Alongside hardware, miners rely on sophisticated mining software that manages the mining process, connects to the blockchain network, and ensures profitability. Popular programs include CGMiner, BFGMiner, and EasyMiner, each offering varying degrees of complexity and customization.

Financial Analysis of Mining

Crypto mining is more than a technical process; it’s a significant financial endeavor that requires strategic planning, investment acumen, and risk management. Understanding the economic landscape of crypto mining is essential for anyone looking to dive into this lucrative yet volatile sector.

Profitability

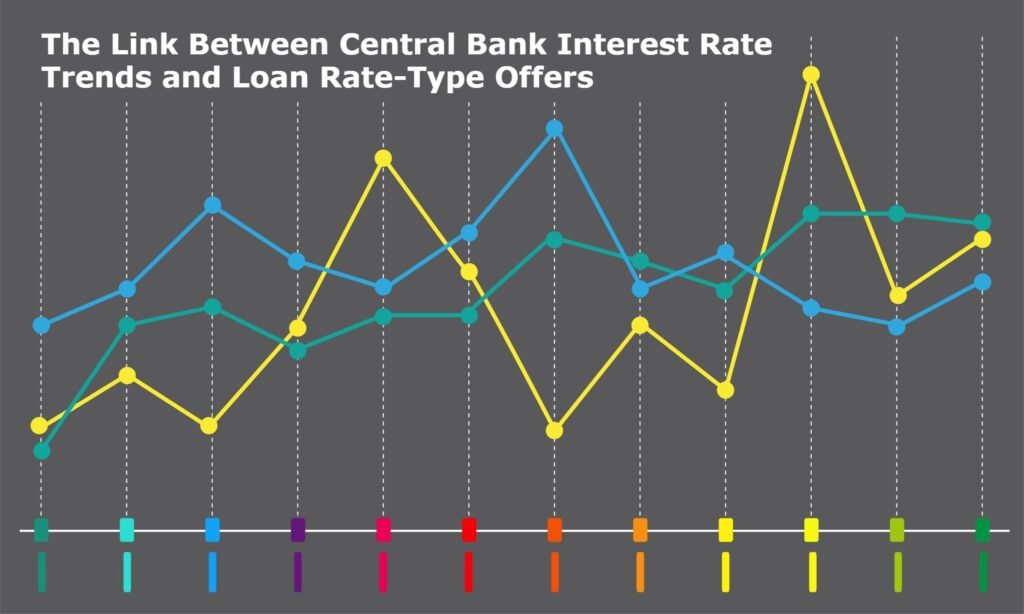

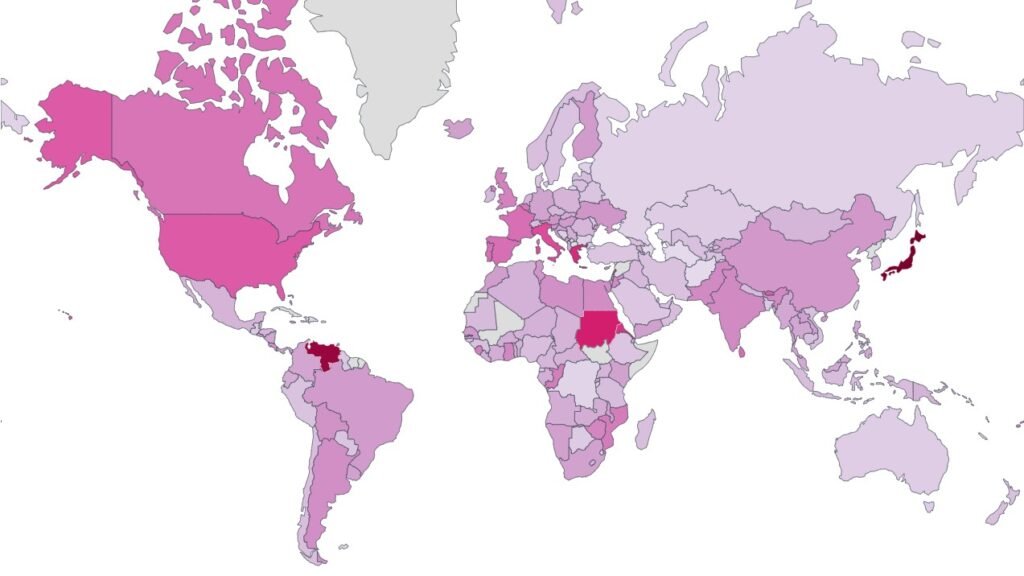

Profitability in crypto mining depends heavily on factors such as electricity costs, hardware efficiency, network difficulty, and the cryptocurrency’s market price. Regions with cheap electricity, like Iceland and Kazakhstan, have become crypto-mining hotspots, significantly affecting global mining distribution.

Initial Investments

Entering the mining world demands substantial initial investment. Modern ASIC mining rigs can range from several thousand dollars to tens of thousands, depending on their power and efficiency. Additionally, continuous maintenance, cooling systems, and facility upgrades add to operational costs.

Risks and Rewards

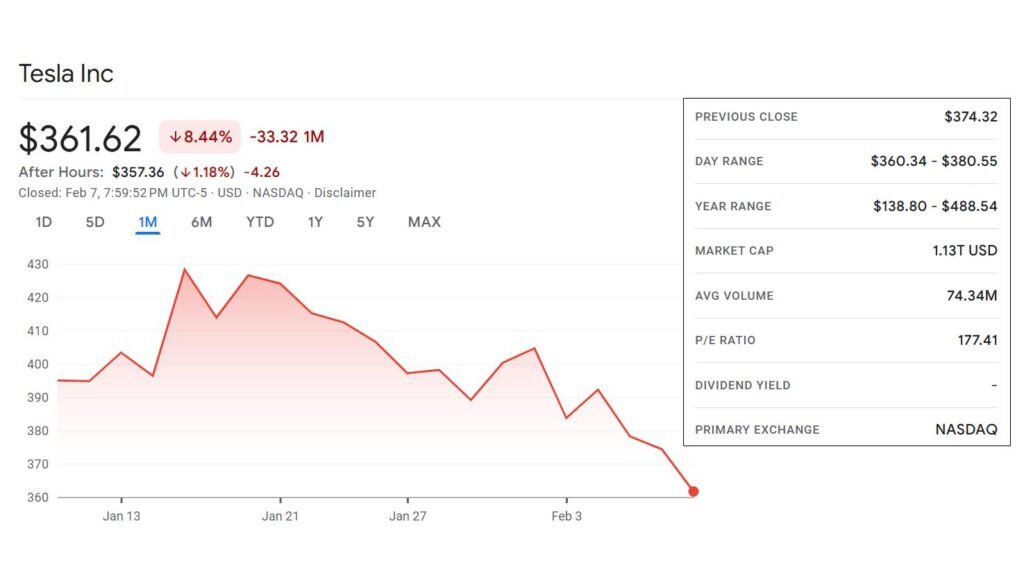

Cryptocurrency mining can be lucrative during periods of high market prices, but miners face considerable risk during market downturns. Mining profitability can quickly shift from highly profitable to unsustainable due to market volatility and fluctuating energy costs.

Environmental Impact

The environmental footprint of crypto mining is a growing concern. Bitcoin mining alone consumes more electricity annually than some small nations, prompting calls for sustainable alternatives. Renewable energy sources, such as solar and hydroelectric power, are increasingly adopted by mining operations aiming to reduce their ecological impact.

Future Trends in Crypto Mining

As the cryptocurrency space evolves, new mining innovations emerge. Ethereum, for instance, recently transitioned from proof-of-work (mining) to proof-of-stake, drastically reducing its energy consumption. Bitcoin miners are continually innovating, seeking efficiency improvements, and exploring renewable energy solutions.

Solaxy (SOLX)

Solaxy is a Layer-2 scaling solution enhancing transaction speed and reducing congestion on the Solana blockchain. With significant initial funding, Solaxy aims to streamline decentralized applications for smoother user experiences.

Bitcoin Bull (BTCBULL)

Bitcoin Bull merges meme culture with investment strategies, rewarding holders based on Bitcoin’s market performance. This community-driven cryptocurrency has rapidly gained popularity among crypto enthusiasts.

MIND of Pepe (MIND)

Blending cryptocurrency with artificial intelligence, MIND of Pepe offers users AI-powered insights into market trends and investment opportunities, demonstrating significant fundraising success.

RED TOKEN

RED TOKEN revolutionizes loyalty programs by using blockchain to offer transparent, decentralized rewards redeemable across various consumer brands, fostering more efficient consumer-brand relationships.

SHELL

Focusing on renewable energy, SHELL facilitates a decentralized marketplace for renewable energy credits. This blockchain project aims to enhance the transparency and efficiency of trading sustainable energy certificates.

Crypto Mining: Striking Digital Gold in the 21st Century

Crypto mining remains a fascinating yet complex arena, integral to the cryptocurrency ecosystem. It blends technology, finance, and environmental stewardship into a unique industry that’s as volatile as it is revolutionary.

What are your thoughts on crypto mining? Is it a golden opportunity or a risky venture? Leave a comment below—we’d love to hear your perspectives! Be sure to check back daily, as we’ll continue to explore this dynamic topic, keeping you informed every step of the way.