|

Getting your Trinity Audio player ready...

|

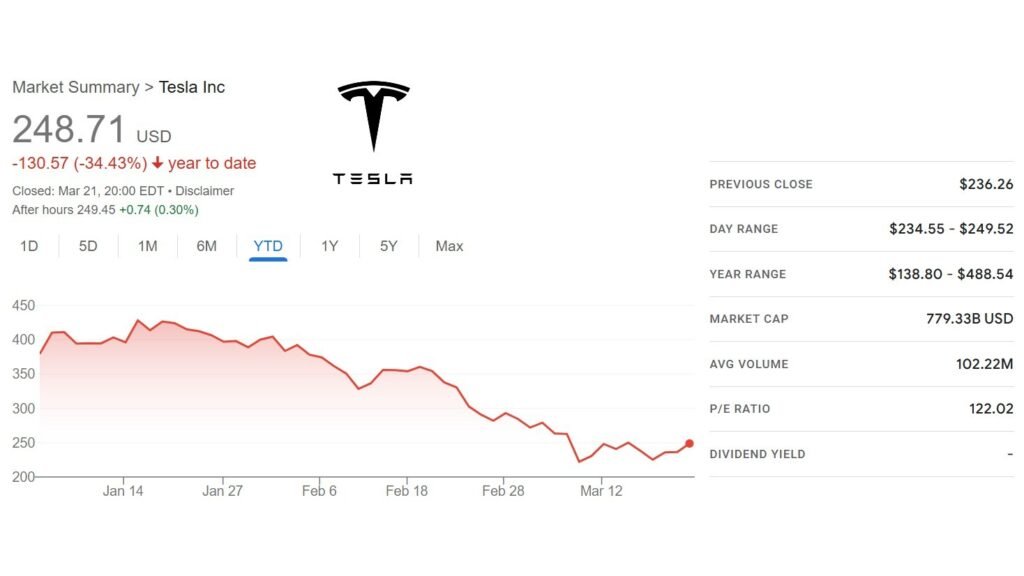

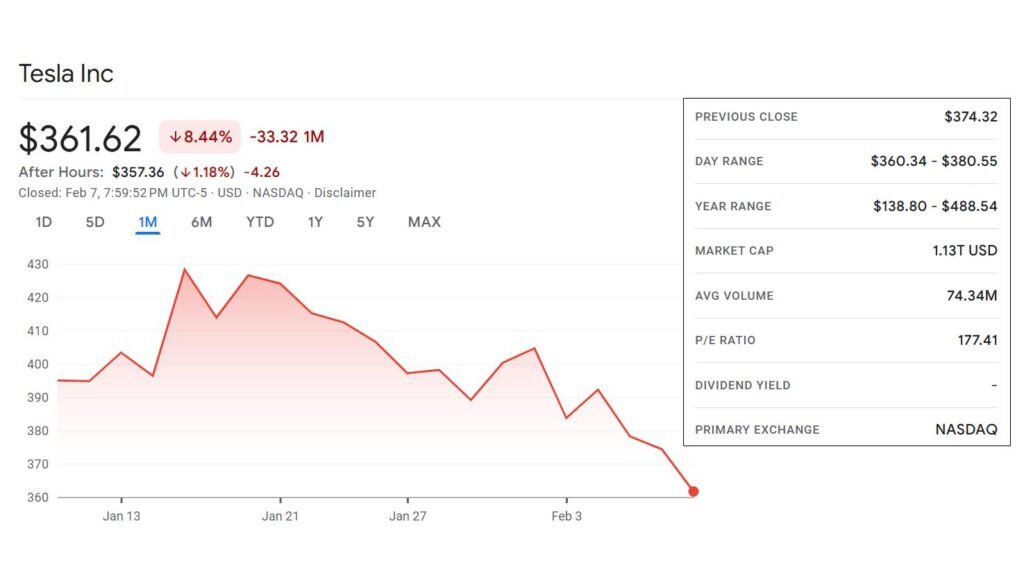

Tesla Motors (TSLA), once considered untouchable on Wall Street, has been rocked by significant volatility in recent weeks, driven primarily by the actions and public demeanor of its charismatic yet controversial CEO, Elon Musk. March 2025 marked a turning point, witnessing Tesla shares plunging to worrying lows not seen in months.

The Musk Effect

On March 11, 2025, Tesla’s stock suffered its steepest single-day drop this year, collapsing by an alarming 15.4% and closing at just $222.15. This marked the lowest point of the month, far removed from its all-time high closing price of $479.86 in December 2024. Analysts and investors point directly at Musk’s public actions, including his controversial political affiliations and his shocking public display—a Nazi salute during a high-profile event—as the catalyst.

This incident sent shockwaves through financial markets worldwide, triggering investor panic and widespread backlash across social media platforms. Influential stakeholders voiced concern over the implications for Tesla’s brand image and international sales, particularly in sensitive markets like Germany, Europe at large, and the United States.

Financial Implications

In the aftermath, Tesla shares continued their struggle, hovering well below previous valuation expectations. By March 21, 2025, despite a rebound closing at $248.71, Tesla’s share price remains nearly 50% below its recent peak, reflecting enduring market skepticism. Investors have become cautious, wary of further volatility linked to Musk’s unpredictable behavior.

Adding fuel to the fire, key Tesla executives, including CFO Vaibhav Taneja, Board Chair Robyn Denholm, and Musk’s brother Kimbal Musk, sold substantial shares following these controversies, amplifying market uncertainty and highlighting internal concerns over the company’s direction under Musk’s leadership.

Global Market Reactions

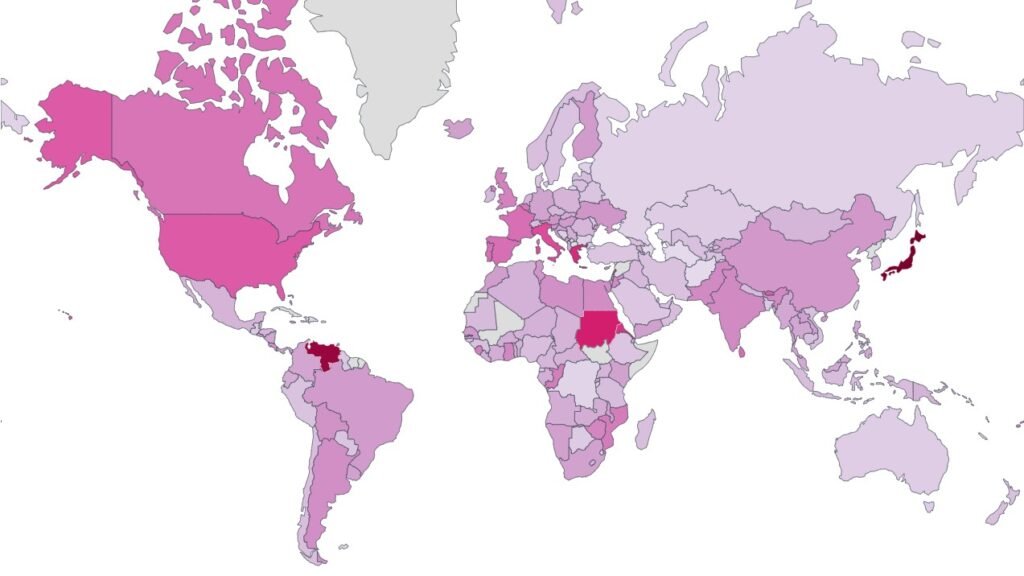

Tesla’s sales, particularly in Europe and China, have notably declined as a direct response to Musk’s political and public controversies. The German market, traditionally strong for Tesla, showed signs of faltering amid public outcry. In China, where Tesla already faces fierce competition, the brand’s perception further eroded, impacting consumer sentiment and future sales forecasts.

Morningstar, a prominent financial analyst firm, revised its fair value estimate for Tesla sharply downward, suggesting current stock prices still reflect significant overvaluation given recent leadership controversies and market sentiment.

What Lies Ahead?

Tesla now stands at a critical crossroads. With Musk’s behavior deeply intertwined with company performance, investors, customers, and market analysts alike remain on edge. Tesla’s future hinges not only on innovative products and technologies but significantly on the ability of its leadership to rebuild trust and market confidence.

Will Tesla Motors recover, or will it continue to be vulnerable to the whims of its leader? We invite you, our readers, to share your insights and predictions in the comments below. Remember to check back daily as we continue our comprehensive coverage and analysis of Tesla Motors and Elon Musk’s unfolding story.