|

Getting your Trinity Audio player ready...

|

Tesla Motors (TSLA), a global leader in electric vehicle (EV) manufacturing, has recently experienced a significant shift in its financial trajectory. Once a Wall Street darling, Tesla is now grappling with declining sales, missed revenue forecasts, and an increasingly competitive EV market. This article examines Tesla’s latest financial data, the factors influencing its current trends, and the broader geopolitical and financial implications of these developments.

TSLA Stock Performance Report

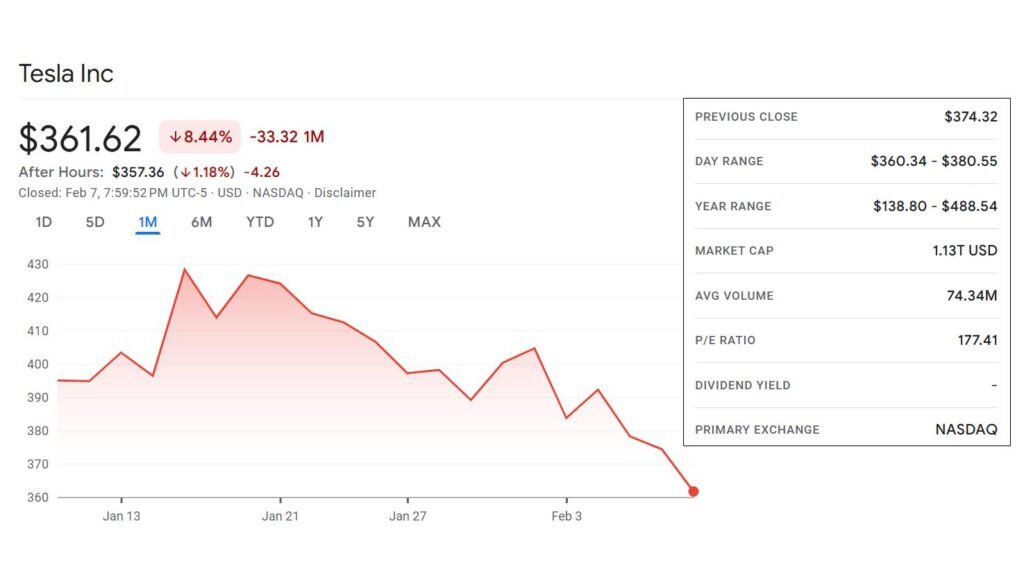

As of February 7, 2025, Tesla Inc. (TSLA) closed at $361.62, marking a 3.46% decline from the previous day’s close of $374.58. The day’s trading range spanned from a low of $357.32 to a high of $380.43, with an opening price of $370.05. The trading volume reached 70,298,258 shares.

Tesla Inc (TSLA) is a key equity in the USA market. The price is currently 361.62 USD with a change of -12.96 (-3.46%) from the previous close. The intraday high is 380.43 USD, and the intraday low is 357.32 USD. The latest open price was 370.05 USD, and the intraday volume was 70,298,258 shares.

Financial Performance Overview

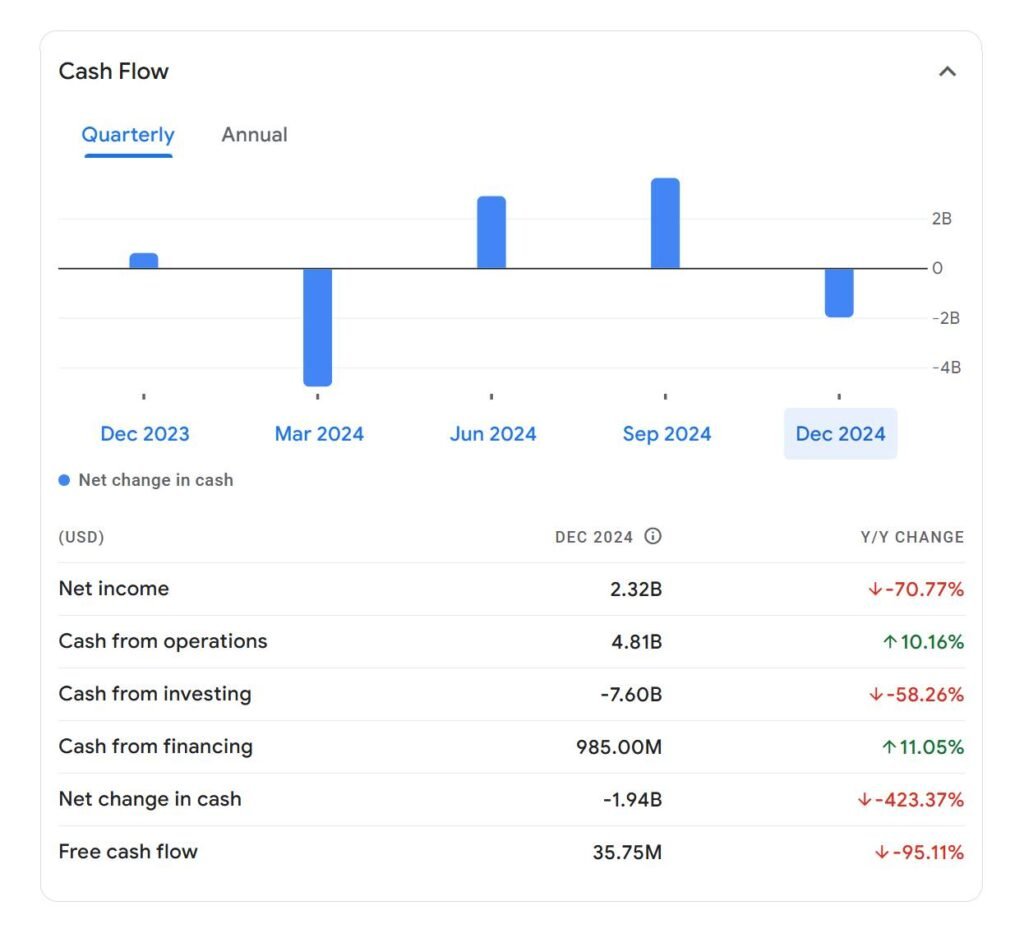

Tesla’s recent earnings reports indicate a downturn in profitability. The company’s net income plummeted by over 70% in Q4 2024, marking one of its most challenging quarters in recent years. Although revenue saw a marginal increase, it fell short of Wall Street’s expectations. Tesla’s share prices responded accordingly, dropping as investors recalibrated their expectations.

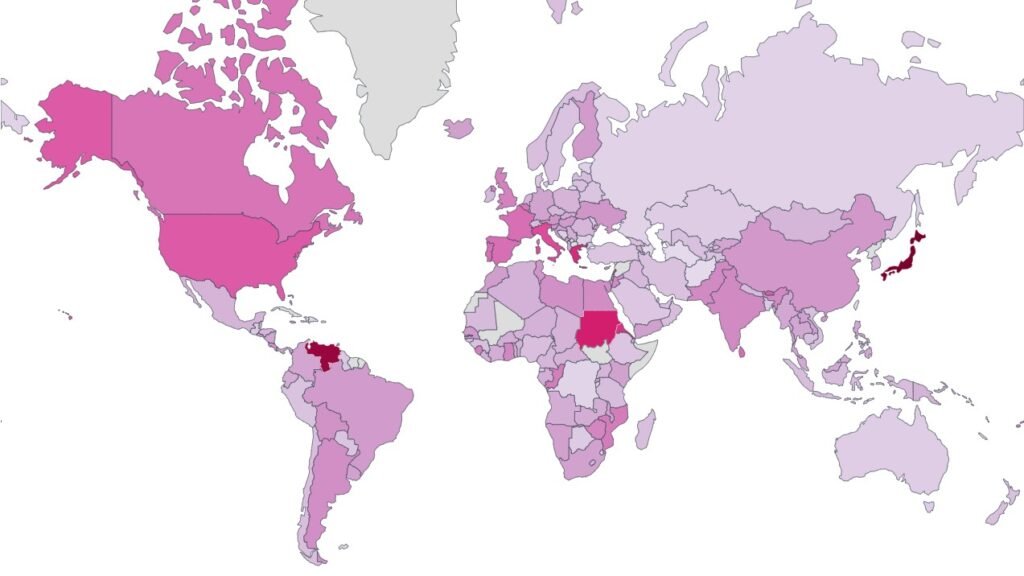

One of the most concerning metrics is the 11.5% year-over-year decline in China-made Tesla sales for January 2025. China, a crucial market for Tesla, has become increasingly competitive, with local manufacturers like BYD surpassing Tesla in EV sales. Furthermore, demand in Europe has also shown signs of weakening, putting additional pressure on Tesla’s global expansion strategy.

Factors Behind the Decline?

Tesla’s financial and geopolitical challenges are closely tied to market fluctuations and international relations.

- China’s EV Market and Government Policies: China’s aggressive push towards domestic EV production has placed Tesla in a precarious position. The Chinese government has favored homegrown brands like BYD through subsidies and incentives, making it harder for Tesla to maintain its previous sales dominance. Tesla’s reliance on the Chinese market for manufacturing and sales makes it vulnerable to geopolitical tensions, particularly if trade restrictions or tariffs come into play.

- U.S. Political Climate and Investor Sentiment: With the upcoming U.S. presidential election in 2024, Tesla’s financial future could be shaped by regulatory and economic policies. Investors are speculating on whether a Republican administration would be more favorable to Tesla’s business model, particularly in terms of deregulation and tax incentives for EV manufacturers.

- Global Supply Chain Disruptions: Tesla, like many automakers, remains exposed to supply chain volatility. Although it has managed to secure lithium and battery supply agreements, disruptions in global logistics or raw material costs could further impact production efficiency and margins.

- Declining Sales and Production Bottlenecks: Tesla’s production at its Shanghai Gigafactory has been impacted by slowing demand and growing competition. While the company remains a dominant force in the EV space, its premium pricing model is being challenged by more affordable alternatives from Chinese manufacturers.

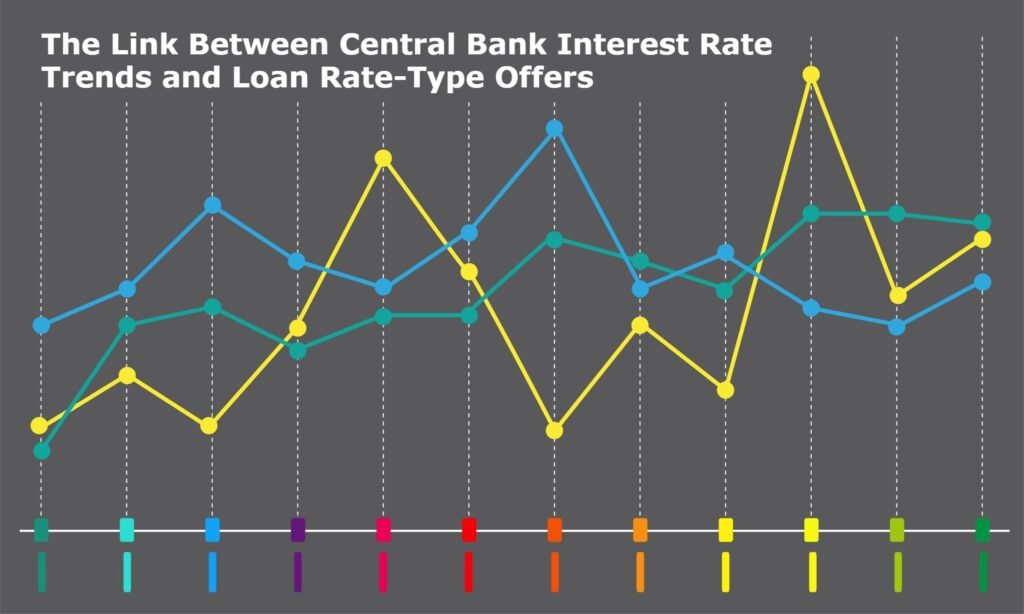

- Macroeconomic Pressures: Rising interest rates and cautious consumer sentiment have dampened EV purchases, affecting not just Tesla but the broader industry. Higher financing costs make EVs less attractive, particularly in regions where government incentives are declining.

- Operational and Technological Concerns: Despite promises of technological advancements, Tesla’s long-touted Full Self-Driving (FSD) software continues to face regulatory hurdles. CEO Elon Musk’s recent announcement that unsupervised FSD may roll out in Texas by mid-2025 remains speculative and does little to immediately impact financial performance.

- Elon Musk’s Support for Far-Right Extremists: Elon Musk has drawn controversy for his public and financial support of far-right extremist groups in both the U.K. and Germany. His involvement with figures known for nationalist and authoritarian ideologies has raised concerns among investors and consumers. Most notably, Musk’s widely publicized use of a Nazi salute at a public event has intensified scrutiny on Tesla’s leadership, damaging its reputation and potentially affecting sales in progressive markets. The growing political divide and its association with Tesla’s CEO may further alienate segments of Tesla’s customer base, particularly in European and North American markets.

Analyst Insights

Morningstar has adjusted its fair value estimate for TSLA to $250 per share, citing expectations of higher adoption of autonomous driving software and growth in the energy generation and storage sectors. Despite this, the current trading price suggests that TSLA is overvalued by approximately 60%, leading to a recommendation for investors to await a price pullback before considering entry.

Tesla’s recent stock performance reflects a combination of internal challenges and external perceptions. While the company faces hurdles in sales and market sentiment, its advancements in technology and strategic initiatives continue to influence investor confidence. Stakeholders should monitor these developments closely to make informed decisions.

Note: This report is based on information available as of February 7, 2025. Market conditions are subject to rapid change.

equilibrado de ejes

Equipos de balanceo: fundamental para el desempeño fluido y óptimo de las dispositivos.

En el ámbito de la avances actual, donde la productividad y la estabilidad del sistema son de alta importancia, los sistemas de ajuste tienen un tarea fundamental. Estos dispositivos especializados están desarrollados para calibrar y asegurar componentes dinámicas, ya sea en maquinaria de fábrica, automóviles de transporte o incluso en dispositivos caseros.

Para los profesionales en soporte de dispositivos y los ingenieros, operar con aparatos de ajuste es esencial para proteger el operación estable y seguro de cualquier mecanismo giratorio. Gracias a estas opciones tecnológicas avanzadas, es posible minimizar significativamente las vibraciones, el ruido y la tensión sobre los rodamientos, prolongando la tiempo de servicio de piezas costosos.

De igual manera trascendental es el rol que desempeñan los sistemas de calibración en la atención al consumidor. El asistencia experto y el conservación constante empleando estos sistemas facilitan ofrecer prestaciones de alta calidad, mejorando la bienestar de los usuarios.

Para los responsables de proyectos, la aporte en sistemas de balanceo y medidores puede ser fundamental para mejorar la rendimiento y productividad de sus sistemas. Esto es sobre todo relevante para los inversores que manejan pequeñas y medianas empresas, donde cada aspecto vale.

Además, los aparatos de equilibrado tienen una vasta utilización en el sector de la seguridad y el supervisión de nivel. Habilitan encontrar potenciales problemas, evitando arreglos caras y problemas a los dispositivos. Más aún, los información recopilados de estos dispositivos pueden aplicarse para perfeccionar sistemas y potenciar la reconocimiento en motores de investigación.

Las sectores de implementación de los equipos de calibración incluyen variadas industrias, desde la elaboración de transporte personal hasta el control del medio ambiente. No influye si se trata de extensas elaboraciones de fábrica o pequeños establecimientos caseros, los equipos de balanceo son esenciales para asegurar un funcionamiento productivo y sin presencia de paradas.

On this platform, you can discover lots of slot machines from famous studios.

Users can experience retro-style games as well as feature-packed games with high-quality visuals and interactive gameplay.

Even if you’re new or an experienced player, there’s something for everyone.

slots

The games are available 24/7 and compatible with laptops and smartphones alike.

You don’t need to install anything, so you can jump into the action right away.

Site navigation is user-friendly, making it simple to explore new games.

Join the fun, and enjoy the excitement of spinning reels!