|

Getting your Trinity Audio player ready...

|

Cryptocurrency markets offer immense opportunity but also significant risk. As an intermediate trader, you may have mastered the basics, yet refining your approach with proven rules, strategies, and tools is crucial for long-term success. This guide covers core trading principles, best practices for mindset and strategy, tips for different trading styles, risk management techniques, popular technical analysis tools, key trading platforms, the evolving regulatory landscape, and specific strategies for top cryptocurrencies. Each section provides structured insights to help elevate your crypto trading game.

1. Trading Rules and Principles in Crypto Markets

Crypto trading inherits many rules from traditional markets, but some principles are especially vital given crypto’s 24/7 global nature and high volatility. Adhering to fundamental trading principles can keep you on track:

Do Your Research

Always “learn everything you can about the asset” before trading it. Understanding a coin’s purpose, technology, and community helps you avoid blind speculation. Never trade a token just because of hype – know what you’re buying and why. In the crypto space, knowledge is power (and protection against scams).

Plan Your Trades

Approach each trade with a clear plan – entry price, exit targets, stop-loss level, and position size. Avoid impulsive decisions. A written trading plan enforces discipline and objectivity. As one guide puts it, create a trading plan and stick to it, adjusting only when data-backed strategy calls for it.

Manage Risk First

A golden rule in investing is “never invest more than you can afford to lose.” This holds doubly true for crypto’s wild markets. Preserve capital by sizing trades conservatively and using stop-loss orders. Successful traders treat risk management as the foundation of their strategy – profits follow from controlling losses.

Stay Rational, Avoid Emotions

Emotional trading is a common downfall. Fear of missing out (FOMO) or panic selling can lead to costly mistakes. “The biggest mistake…is trading on emotion”, leading to buying high in euphoria and selling low in fear. Commit to a mindset of patience and rationality: understand what you are buying, be patient, do your homework, and be rational at all times.

Adapt to Market Dynamics

Crypto markets are highly dynamic and don’t exist in a vacuum. Conditions can shift rapidly with news, global events, or even a tweet. Stay alert and adaptable. Be ready to pivot your strategy when market structure changes – for example, when a bull trend turns into a bearish downturn or vice versa.

Continuous Learning

Intermediate traders should continue educating themselves. Study both Technical Analysis (TA) and Fundamental Analysis (FA) – TA focuses on price charts and momentum, while FA examines the project’s team, technology, and real-world use. Mastering technical skills is essential, but also keep an eye on fundamentals and news that could affect your trades. As the saying goes, “plan your trade and trade your plan”, but also keep learning and refining that plan with experience.

2. Best Practices: Mindset, Preparation, Strategy, and Diversification

Successful trading is as much about how you think and prepare as it is about what you trade. Intermediate traders should cultivate a professional approach to the crypto market. Key best practices include:

Cultivate a Trader’s Mindset

Treat trading like a business. This means setting realistic goals, staying patient, and remaining emotionally neutral about wins or losses. Detach ego from trading – losses are not personal failures but lessons. Aim for consistency over home runs. Developing emotional resilience will prevent impulsive decisions during volatile swings. Remember that discipline and patience are often more important than raw market knowledge in the long run. One practical tip is to take regular breaks and avoid “over-trading” out of boredom; sticking to high-probability setups yields better results than constant churn.

Comprehensive Preparation

Before entering any trade, do thorough preparation. This includes performing analysis (both technical charts and fundamental news checks), setting clear trade parameters, and even practicing the strategy. Many intermediate traders keep a journal of their trades to review what works and what doesn’t. Preparation also means ensuring you have the right tools ready – charting software, news feeds, price alerts – so you’re not caught off guard. Essentially, plan the trade and be prepared for different outcomes (your plan B and C if price goes opposite).

Defined Strategy

By the intermediate stage, you should have one or more go-to trading strategies. Whether it’s a trend-following strategy, mean reversion, breakout trading, or arbitrage, define your method and rules. Random trading is akin to gambling. For example, you might decide “I will trade bullish breakouts from key support levels using 4-hour charts, with RSI confirmation” – that’s a defined strategy. Sticking to it prevents rash, emotion-driven bets. Over time, refine your strategies and develop a personal trading system that suits your risk tolerance and schedule. It’s fine to learn from others, but ultimately tailor a system that you’re comfortable executing consistently.

Risk Management and Capital Preservation

Good traders are risk managers first. Always use stop-loss orders to cap downside on each trade (more on this in Section 4). A common guideline is to risk only a small percentage of your capital per trade (often 1-2%) so that no single bad trade hurts you badly. Also, avoid over-leveraging – using high leverage in crypto can wipe out positions quickly if the market moves against you. Accept that not every trade will be profitable; the goal is that your winners outweigh your losers over time, and that requires cutting losses early and letting winners run when possible.

Portfolio Diversification

In crypto, putting all your funds into one coin is highly risky. Diversifying across multiple cryptocurrencies can smooth out volatility. Ideally, hold a mix of large-cap coins (e.g. Bitcoin, Ethereum), some mid-caps, and only a small portion in very speculative small-caps. Diversification mitigates the impact of any single asset’s downturn. For example, if your portfolio spans Bitcoin (store-of-value), Ethereum (smart contract platform), and a few altcoins in different sectors (DeFi, gaming, etc.), a crash in one sector won’t sink your entire portfolio. Balance is key: don’t over-diversify into too many assets either – hold enough assets to spread risk, but not so many that you can’t keep track of them. The classic rule from traditional investing applies: “never put all your eggs in one basket.”

Security and Asset Management

Part of best practice is protecting your assets. Use reputable exchanges for trading, enable two-factor authentication (2FA) on accounts, and consider using hardware wallets for long-term holdings not actively being traded. Many traders keep only the funds needed for active trades on exchanges and store the rest offline. High-profile exchange failures (from Mt. Gox in 2014 to FTX in 2022) have shown the importance of not exposing all your capital to third-party risk. By practicing good security hygiene (strong passwords, withdrawal whitelists, secure storage), you safeguard your trading business against theft or platform risk.

3. Day Trading, Swing Trading, and Long-Term Investing

Different trading styles require different tactics. Crypto traders generally fall into three categories based on trade duration: day traders, swing traders, and long-term investors (HODLers). Each style has its own tips and tricks:

Day Trading: Rapid-Fire Opportunities

Day trading involves executing multiple trades within the same day (or even within hours) to profit from short-term price fluctuations. Day traders close all positions by day’s end, avoiding overnight risk. Tips for day trading crypto include:

Focus on Liquidity and Volatility

Day traders need price movement and trading volume. Stick to highly liquid markets (e.g. BTC, ETH, major altcoins) where you can enter and exit quickly. Fortunately, crypto is volatile – double-digit intraday swings are not uncommon. Volatility is a double-edged sword: it provides profit opportunities but can “throw even advanced traders for a loop” if risk isn’t controlled. Choose coins that move, but manage the downside tightly.

Use Tight Risk Controls

Because you’re making frequent trades, small mistakes can compound. Employ strict stop-loss orders on each trade to cap losses. Many day traders risk no more than 1% (or even less) of their capital per trade, given the high frequency. It’s also crucial to consider fees – frequent trading means trading fees can eat into profits. Some platforms offer zero commission on certain pairs (e.g. Binance.US had free trading for BTC/ETH pairs), but others hide fees in spreads. Be aware of your true transaction costs.

Develop Quick Decision-Making

Day trading demands fast reactions. You’ll likely be using short time-frame charts (1-minute, 5-minute, 15-minute) and technical indicators for intraday signals. Common day trading strategies include scalping (very quick in-and-out for a few pips) and momentum trading (riding a strong intra-day trend). Have a clear system for entry and exit – for example, you might trade breakouts above a certain price level with high volume confirmation. Avoid chasing moves; if you miss a trade, move on to the next setup rather than FOMO-buying late.

Stay Agile and Manage Stress

Since crypto markets run 24/7, day traders must set their own “work hours” and stick to a routine to avoid burnout. It’s easy to get glued to the screen, but fatigue leads to mistakes. Trade during the times of day you perform best (some prefer high-volume periods like U.S. or Asian market hours). Use tools like price alerts to avoid constantly staring at charts. Crucially, don’t revenge-trade if you incur a loss – step back and reset rather than trying to immediately win it back, which often leads to bigger losses. Given the intense pace, many would-be day traders actually find a slower style is more profitable unless you truly have the time and temperament for rapid trading.

Swing Trading: Riding Medium-Term Trends

Swing trading occupies the middle ground between day trading and long-term investing. Swing traders hold assets for several days to weeks, aiming to capture a “swing” or portion of a larger price move. This strategy is well-suited for those who can’t monitor markets constantly but still want to trade actively. Key points for swing trading:

Blend Technical and Fundamental Analysis

Swing traders often use daily or 4-hour charts to find trends and entry points. Technical tools like trend lines, moving averages, and oscillators help identify when an asset is oversold in an uptrend (a potential buy) or overbought in a downtrend (potential sell). However, because positions last days or weeks, fundamentals and news play a role too. Swing traders keep an eye on major news (e.g. a protocol upgrade announcement or macroeconomic news) that could fuel a multi-day move. In crypto, swings can be driven by sentiment shifts or events like network upgrades. Being aware of the narrative helps time your swings.

Patience with Positions

Unlike day traders, swing traders don’t need to watch markets tick-by-tick. Once you’ve entered a trade based on a favorable setup, try to let the trade play out over the coming days. Minor intraday fluctuations are less important than the overall trajectory. It can help to set wider stop-losses that give the trade room to breathe (since noise is higher on short timeframes) – but still define that stop based on technical invalidation of your idea. Some swing traders use trailing stops to lock in profit once a trade moves significantly in their favor.

Identify Trends and Ranges

Crypto markets often go through periods of trending behavior followed by choppy consolidation. Swing traders seek to catch those trend periods. For example, if Bitcoin breaks out of a long consolidation into a clear uptrend on the daily chart, a swing trader might buy and ride that trend for a few weeks. Conversely, in a sideways market, swing strategies might shift to range-trading – buying near support, selling near resistance. The ability to discern the market’s mode (trending or ranging) is valuable; one popular method is using moving averages alignment or the Aroon indicator (which measures trend strength) to judge trend conditions.

Pros and Cons

Swing trading is often considered a less time-intensive approach than day trading (good for those with jobs or other commitments) and can be quite profitable in volatile markets. As noted in one guide, it “takes less time and effort than day trading” and “is not as time-consuming,” but still requires a solid strategy and risk management.

The risk is that overnight news can gap prices beyond your stop (crypto trades 24/7, but illiquid hours can still see jumps). Thus, swing traders must account for event risk (maybe avoiding holding through known major announcements unless that’s part of the strategy). Overall, swing trading offers a balanced approach: active trading with a bit more breathing room to plan and react.

Long-Term Investing: HODLing for Value

Long-term investing (HODLing) involves holding cryptocurrencies for months or years, focusing on the asset’s long-term appreciation potential rather than short-term price moves. This strategy aligns with investors who believe strongly in the future of certain cryptocurrencies or the crypto market as a whole. Tips for long-term crypto investing include:

Choose Quality Projects

The crypto landscape has thousands of coins, but only a fraction have lasting value. Long-term investors concentrate on fundamentally strong assets – those with widespread adoption, solid development teams, clear use cases, and network effects.

Bitcoin (as digital gold/store of value) and Ethereum (as the leading smart contract platform) are common staples of long-term portfolios. Beyond these, one might include a few top altcoins in various sectors (smart contract competitors, DeFi platforms, etc.) after thorough due diligence.

The mantra is “buy what you know” – invest in projects you understand and have conviction in.

Stagger Entries with DCA

Timing the market is notoriously difficult. Long-term holders often use dollar-cost averaging (DCA) – investing a fixed amount at regular intervals (e.g. weekly or monthly) – instead of trying to pick exact bottoms. DCA smooths out your cost basis over time and reduces the stress of “is now the perfect time to buy?” You might, for example, buy a bit of Bitcoin every month regardless of price. This technique proved effective historically, as buying consistently during down periods often yielded significant gains when the market eventually rebounded.

Stomach the Volatility

Even as a long-term believer, you’ll experience gut-wrenching volatility. It’s not uncommon for Bitcoin or Ethereum to drop 50%+ in a bear market, only to recover later.

Emotional fortitude is key – avoid the urge to panic sell during corrections. If your thesis for holding the coin is intact, a price dip might be an opportunity to accumulate more rather than a reason to capitulate. Historical data shows that “what falls may bounce back later” in crypto, and indeed many long-term investors who simply held through past bear markets have been rewarded in subsequent bull runs. As Bankrate noted, “would-be day traders might be better off simply taking a buy-and-hold strategy”, picking likely winners and riding the “upward wave” without trying to time every twist and turn.

Secure Storage and Staking

Long-term investors should prioritize security of their holdings. Consider using cold storage (hardware wallets) for significant balances. This mitigates risks of hacks or exchange failures over the years you plan to hold. Additionally, explore ways to make your assets productive. For instance, Ethereum holders can stake their ETH in the network’s proof-of-stake system to earn yield, and many other coins offer staking or interest-bearing accounts. Earning 4-10% APY (depending on the asset and method) can increase your holdings over time, though be mindful of counterparty risk if using third-party platforms. Always balance the reward of yields against any added risks.

Periodic Review, Minimal Trading

“HODL” doesn’t mean you never check your portfolio. It’s wise to review your investments periodically (say every few months or when major news hits). Ensure the project is still on track fundamentally – for example, if a coin you hold encounters serious development issues or regulatory problems, a long-term investor might reevaluate the position. However, avoid the temptation to tinker too often.

Long-term strategy is about capturing the large upward trend; frequent chopping in and out can undermine that. Tax-wise, holding longer also brings advantages in some jurisdictions (e.g. lower capital gains tax for holdings over one year in certain countries).

Conclusion:

In summary, day trading seeks immediate profits from intraday swings (high effort, high activity), swing trading targets multi-day trends (medium effort, tactical positioning), and long-term investing bets on the crypto market’s growth over years (low activity, high conviction).

Many traders blend these approaches with separate funds – for example, maintaining a core long-term portfolio while allocating a smaller amount to short-term trades. Decide what mix suits your lifestyle and risk tolerance. Often, starting with a long-term HODL approach on major assets, then gradually increasing activity (swing trades or occasional day trades) as you gain experience, is a prudent path for intermediate traders.

No matter the style, always keep the big picture in mind: the goal is to grow your portfolio over time, and each approach is just a different route to that destination.

4. Risk Management Techniques (Stop-Losses, Position Sizing, Discipline)

Managing risk is absolutely critical in crypto trading – it’s what separates long-term survivors from those who blow up their accounts. Intermediate traders should already appreciate that no strategy wins 100% of the time, so protecting yourself when trades go wrong is paramount. Here we discuss key risk management techniques:

Position Sizing – The 1-2% Rule

One of the first questions to ask before a trade is “how much of my capital should I put at risk?” Position sizing is the practice of allocating an appropriate amount of your portfolio to each trade.

A common guideline is risking only a small percentage of your total capital on any single trade, often around 1-2%. This means if your stop-loss is hit, your loss is limited to that fraction of your account. For example, if you have a $10,000 portfolio and use a 2% risk per trade, you’d risk $200 on a trade. If your trade setup has a $50 stop-loss distance, you’d take at most 4 units of the asset (4 * $50 = $200 risk).

Sticking to modest position sizes ensures that even a string of losses won’t devastate your account – you can live to trade another day. Many experienced traders position size before thinking about profits; they focus on limiting downside first. This discipline prevents the temptation of going “all in” on a sure bet – which in crypto, can always surprise you.

Stop-Loss Orders – Cutting Losses Early

A stop-loss order is a pre-set instruction to automatically sell (or buy, in case of a short position) an asset if it reaches a certain price against you. It’s a fundamental risk management tool to cap losses. For instance, if you buy ETH at $2,000, you might set a stop-loss at $1,800; if ETH drops to that level, it triggers a sale to prevent further loss.

In essence, “stop-loss orders automatically sell an asset when its price hits a predetermined level, minimizing losses during downward trends”. Good practice is to place your stop at a logical level on the chart (e.g. below a key support level that, if broken, invalidates your trade thesis).

Honor your stops – don’t cancel or move them on a whim, which defeats their purpose. By enforcing a strict max loss per trade (as determined by your stop and position size), you take emotion out of the decision. Likewise, consider using take-profit orders for targets: these automatically secure gains when price hits your planned exit, which can prevent greed from making you overstay a trade.

Some traders use a trailing stop, which moves up with price in profitable trades to lock in gains if the price reverses. In crypto’s fast market, stop-losses are essential insurance – think of them as your seat belt on a volatile ride.

Leverage and Margin – Use Cautiously or Not at All

Crypto exchanges often offer leveraged trading (using margin or futures) which can amplify gains and losses. As an intermediate trader, be extremely cautious with leverage. High leverage can turn a small market move into a large loss.

A good rule is to use the lowest leverage necessary or avoid it until you have significant experience. If you do trade on margin, always have a stop-loss and monitor positions actively, as liquidation (the forced closure of your position if losses exceed your margin) can occur quickly in volatile swings.

Many seasoned traders stick to low leverage (2x–5x at most) or none, preferring to size up positions in non-leveraged spot markets instead. Keep in mind that a leveraged position may also incur fees/funding costs over time, which can eat into profits. The bottom line: leverage is a tool for advanced strategy, not a shortcut for small accounts. Use it sparingly and with robust risk controls.

Emotional Discipline – Mastering Trading Psychology

Even with the best plan and tools, your mindset under pressure will determine outcomes. Emotional discipline means sticking to your strategy especially when fear or greed tempts you to deviate. Common pitfalls to avoid:

Revenge Trading

After a loss, feeling compelled to immediately win it back. This often leads to entering bad trades impulsively. It’s better to step away, cool off, review what went wrong, and come back with a clear head. As one crypto trading psychologist noted, making decisions based on anger or desperation is akin to a gambler’s “just one more hand to win it back” mentality – a spiral to bigger losses. Recognize this urge and stop it in its tracks.

FOMO and Overtrading

Jumping into a trade because everyone on Twitter is hyping a coin or because a price is mooning can lead to buying tops. Remember, there will always be another opportunity. If you missed one, let it go. Stick to your vetted setups rather than chasing every hot pump. Similarly, don’t confuse activity with productivity – taking many trades doesn’t guarantee better results, and can degrade your focus. Sometimes the best action is to sit on your hands until a real opportunity appears.

Biases and Ego

Traders often become biased after a few wins (overconfidence) or a streak of losses (cowardice). Keep a level head. Don’t increase position sizes drastically after big wins out of euphoria, and don’t give up or deviate from a sound strategy after a few losses. Following a consistent process is key. It may help to quantify your edge – e.g., if historically your strategy wins 60% of the time with a 1.5:1 reward-to-risk, trust that probability over a series of trades rather than getting swayed by short-term outcomes.

Mindfulness and Breaks

Incorporate habits to maintain emotional balance. This might mean taking breaks after a big win or loss (to avoid rash follow-up trades), doing a brief pre-trade meditation or checklist, and ensuring trading doesn’t consume your entire life. A healthy routine outside of trading (exercise, hobbies) can improve decision-making when you are trading.

Remember, “when you are trading, you are battling the survival brain” and need to stay in rational control. Tools like meditation or simply stepping away periodically help keep the analytical brain in charge instead of the fight-or-flight instinct.

Diversification and Hedging

As touched on earlier, diversifying your trading portfolio reduces single-trade or single-asset risk. In addition, intermediate traders sometimes use hedging strategies. For example, if you hold a lot of Bitcoin long-term, you might hedge short-term downside by taking a short position in Bitcoin futures when you anticipate a correction – this can offset losses on your holdings.

Another hedge is rotating into stablecoins during highly uncertain times. A notable aspect of crypto is that it currently lacks wash sale rules that stocks have, meaning U.S. traders can sell a coin to USD or a stablecoin to realize a loss for tax purposes and buy it back immediately without waiting (wash sale rules, which disallow this for stocks, “are not applied to crypto…at least for now”). This enables strategic tax-loss harvesting as a form of risk management/optimization.

Always consult tax professionals or resources, but be aware of this difference which can be used to your advantage under current laws.

5. Technical Analysis: Key Indicators and Charting Tools

Technical analysis (TA) is a cornerstone of crypto trading. Given that cryptocurrencies often lack traditional fundamentals (like earnings or cash flow), traders rely heavily on price charts and technical indicators to gauge market sentiment and predict future moves. As an intermediate trader, you should become fluent with the most popular TA indicators and the platforms that provide charting capabilities. Below we cover essential technical indicators and how to use them, as well as the go-to tools for charting crypto trends.

Popular Technical Indicators

Technical indicators are mathematical calculations on price and/or volume, plotted on charts to reveal trends, momentum, and potential reversal points. There are hundreds of indicators, but a handful appear in almost every crypto trader’s toolkit:

Moving Averages (MA)

These are trend-following indicators that smooth out price data by creating a constantly updated average price. Common types are the Simple Moving Average (SMA) and Exponential Moving Average (EMA). For example, the 50-day and 200-day SMA are widely watched on daily charts – a crossover between them can signal trend changes (the “golden cross” or “death cross”).

Moving averages help identify the overall direction of the market (uptrend, downtrend, or range) by filtering out short-term noise. Traders often use MAs as dynamic support/resistance; e.g. if Bitcoin’s price is above the 200-day MA, that MA may act as a support on pullbacks. MAs work best in trending environments and are less useful in choppy, sideways markets.

Relative Strength Index (RSI)

RSI is a momentum oscillator that measures the magnitude of recent price changes to assess overbought or oversold conditions. It oscillates between 0 and 100. Classic interpretation: an RSI value above 70 indicates an asset might be overbought (price risen too far, too fast) and due for a pullback, while an RSI below 30 suggests oversold conditions (price fallen too fast) and potential for a bounce. For instance, if Ethereum’s daily RSI drops to 25 after a sharp decline, a swing trader might anticipate a relief rally.

RSI is also used to spot divergences – if price makes a new low but RSI makes a higher low, it’s a bullish divergence hinting selling momentum is weakening. Keep in mind, in strong trends RSI can stay in overbought/oversold territory for extended periods, so it’s often best combined with other signals.

Moving Average Convergence Divergence (MACD)

The MACD is a trend-following and momentum indicator that shows the relationship between two moving averages of price. It consists of the MACD line (the difference between, say, the 12-day EMA and 26-day EMA), the signal line (a 9-day EMA of the MACD line), and a histogram showing the difference between MACD and signal.

When the MACD line crosses above the signal line, it’s a bullish signal (indicating momentum turning up), and vice versa for a bearish crossover. MACD is popular for identifying trend changes or momentum shifts. For example, a MACD bullish crossover below the zero line can signal an early trend reversal up.

Traders use it in conjunction with RSI or others – e.g. requiring both a MACD crossover and RSI out of oversold for a stronger buy signal. It’s a lagging indicator (based on moving averages), so it works well as a confirmation of trend rather than a precise entry tool.

Bollinger Bands

Bollinger Bands consist of a moving average (typically 20-day SMA) and two bands plotted ±2 standard deviations around that MA. The bands expand or contract based on volatility. When volatility increases, bands widen; when volatility is low, bands narrow.

Prices tend to oscillate within the bands ~95% of the time. Traders use Bollinger Bands to gauge volatility and possible mean reversion. For instance, if Bitcoin’s price touches the upper band after a strong rally, it may indicate short-term overextension (price might revert toward the middle MA).

Conversely, if bands squeeze very close (low volatility), it often precedes a big move – a “Bollinger Band squeeze” can signal a breakout is coming (though not the direction). Some strategies involve buying when price hits the lower band (oversold) and selling at the upper band (overbought) in range markets. Bollinger Bands essentially give a visual of how far from the mean the price is, and extreme deviations often normalize.

On-Balance Volume (OBV)

OBV is a volume-based indicator that tracks cumulative buying and selling pressure. It adds volume on up-days and subtracts volume on down-days, producing a running total.

The idea is that OBV rises when volume on up-days outpaces volume on down-days, indicating accumulation; falling OBV indicates distribution. Traders watch OBV to confirm trends or spot divergences. For example, if a coin’s price is making new highs but OBV is flat or falling, it suggests the rally may lack true volume strength and could falter.

On the other hand, a rising OBV while price is still in a range might hint that smart money is quietly accumulating, presaging an upward breakout. OBV essentially “reflects the relationship between price and volume” and can signal whether volume supports the price trend. It’s especially useful in crypto, where volume flows (often driven by retail traders) can lead price.

Fibonacci Retracement Levels

Not exactly an “indicator” with a formula, but a popular tool – Fibonacci retracements are horizontal lines at key Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, 78.6%) drawn between a significant price high and low. These levels tend to act as support or resistance areas where price might retrace before continuing the trend.

Crypto traders commonly look at the 38.2%, 50%, and 61.8% retracement levels after a big move. For example, if Litecoin jumps from $50 to $100, a pullback might find support near ~$75 (50% retrace) or ~$69 (61.8% retrace). Fibonacci levels are self-fulfilling to some extent because many traders monitor them. They are used to plan entries (buying a dip at a Fib support) or exits (taking profit at a Fib resistance in a retracement rally).

Combining Fibs with other indicators (like seeing an RSI oversold at a 61.8% retracement support) can improve reliability.

Others – Stochastic, Aroon, Ichimoku, etc.

There are numerous other indicators. The Stochastic Oscillator (another momentum tool similar to RSI, indicating overbought/oversold based on recent closing price relative to range) is often used in pair with RSI for confirmation.

The Aroon indicator helps determine if a coin is in a trend or oscillating by measuring time since highs and lows. The Ichimoku Cloud is a comprehensive system plotting several lines to indicate trend and momentum at a glance – if price is above the “cloud,” trend is bullish, below is bearish, etc.. Intermediate traders can explore these as they advance.

It’s important to note that all indicators have strengths and weaknesses. There is no magic indicator that always works. Often, traders combine 2-3 indicators to filter signals (for example, require a moving average trend confirmation, plus an oscillator divergence for entry).

Also, pay attention to price action itself – support/resistance levels, candlestick patterns, and volume at price levels are vital. Indicators derive from price/volume; they are aids, not substitutes for reading the chart.

Charting Tools for Crypto Analysis

To apply these indicators and study charts, traders rely on charting platforms. The crypto industry has several excellent tools:

TradingView

TradingView is arguably the most popular charting platform among crypto traders (as well as stock and forex traders). It offers powerful, interactive charts with a vast library of built-in indicators and drawing tools, plus the ability to add custom scripts.

TradingView’s interface is user-friendly yet extremely feature-rich – you can plot multiple indicators, compare different assets, and even backtest strategies. It also has a social component where traders publish ideas and analyses.

Many exchange websites embed TradingView charts due to their quality. In short, “TradingView is the go-to choice for most traders, with powerful charting tools and an easy-to-use interface”.

Intermediate traders should get comfortable with TradingView: learn how to mark support/resistance, draw trend lines or Fibonacci retracements, set up indicator combinations, and use features like alerts (e.g. notify if Bitcoin crosses above a certain price).

TradingView also allows saving chart layouts and watchlists to keep your analysis organized. A free account offers a lot; paid plans give more indicator slots and alert options, which you might consider as you progress.

Crypto Exchange Charts

Major exchanges like Binance, Coinbase Pro, Kraken, etc., have their own chart interfaces. Many of these are actually powered by TradingView as well.

When actively trading on an exchange, you might use their built-in charts for quick decisions. They typically allow adding common indicators and switching timeframes. However, they may not be as customizable as TradingView’s standalone platform.

Still, for execution purposes, get familiar with your exchange’s charting – know how to quickly toggle between pairs, how to draw a line if needed, and how to interpret the order book and depth chart (an often overlooked tool that shows current buy/sell orders – useful for gauging immediate supply/demand).

CoinMarketCap / CoinGecko

These are price-tracking websites rather than full charting platforms, but they offer at-a-glance charts and a wealth of market data.

CoinMarketCap, for example, “provides free access to current and historic data for Bitcoin and thousands of altcoins” and ranks cryptocurrencies by market capitalization. As a trader, you might use CoinMarketCap or its competitor CoinGecko to research a token’s background, check its circulating supply, explore which exchanges it’s listed on, and view a basic price chart and volume data across exchanges. They also show metrics like dominance (Bitcoin’s market cap as a percentage of total crypto market cap) and trending coins.

While serious analysis is done on TradingView or exchange charts, aggregators like these are invaluable for research and quickly checking stats.

Specialty Tools

Depending on your needs, you might incorporate other tools. For instance, blockchain explorers (like Etherscan for Ethereum) let you analyze on-chain data (useful for seeing big transactions or token holder distributions).

On-chain analysis platforms (Glassnode, CryptoQuant, etc.) provide charts on metrics like active addresses, miner flows, and exchange reserves – more for macro analysis.

Portfolio trackers (Blockfolio/FTX app, Delta) help manage and monitor your holdings across platforms. And for those into algorithmic trading, platforms like Coinigy or TradingView’s Pine Script allow you to code and test strategies.

As an intermediate trader, it’s wise to gradually familiarize yourself with tools that match your strategy – for example, if you trade DeFi tokens on DEXes, tools like DEX aggregators and DeFi analytics dashboards may be relevant.

But to avoid overload, start with mastering one or two primary platforms (TradingView for analysis and maybe a portfolio tracker for monitoring) before branching out.

6. Crypto Trading Platforms and Tools (Exchanges, Analytics, Resources)

Navigating the crypto market requires using reliable platforms for trading, analysis, and information. Here we compare some of the most widely used exchanges and tools that intermediate traders rely on:

Exchanges (Trading Platforms)

Crypto exchanges are where you execute trades – buying or selling cryptocurrencies for other cryptos or fiat. When choosing an exchange, consider factors like security, fees, supported coins, interface, and regulatory compliance. Two of the most prominent centralized exchanges globally are Binance and Coinbase, which cater to different audiences:

Binance

A global exchange launched in 2017, known for its extensive selection of altcoins and low trading fees. Binance offers advanced trading features (spot trading, futures, options, margin trading, staking, etc.) and is geared toward more experienced traders. Its interface can be complex for newcomers, but it provides a suite of tools (charting, multiple order types, APIs for bots) that seasoned traders appreciate.

Binance’s fees are typically around 0.1% per trade (even lower with high volume or using their BNB token for fees) – significantly cheaper than many competitors. It also has deep liquidity in most trading pairs, meaning it handles large orders without much slippage.

On the downside, Binance’s global platform is less regulated (its availability in the U.S. is via a separate entity Binance.US due to regulatory restrictions). Still, Binance is often the top choice for active crypto traders seeking variety and low costs: it “supports a broader range of cryptocurrencies and trading options compared to Coinbase”.

If you’re trading small-cap altcoins, there’s a good chance Binance lists them. Just be mindful of using proper security measures (Binance offers features like address whitelisting and device management) and consider withdrawing to personal wallets for long-term holds.

Coinbase (Pro)

Coinbase is a U.S.-based exchange founded in 2012, often considered one of the most user-friendly platforms. It has a strong reputation for regulatory compliance and security (as a publicly listed company, it adheres to financial regulations and has hefty security protocols like insured custodial holdings).

Coinbase’s main platform is extremely simple, aimed at beginners wanting to buy crypto with fiat easily. For traders, Coinbase offers Coinbase Pro (now merging into the unified Coinbase Advanced Trade interface) which has lower fees and more trading tools.

Coinbase’s interface is clean and intuitive, making it ideal for those newer to active trading. It supports a decent variety of major coins and popular altcoins, though far fewer than Binance. The trade-off for Coinbase’s simplicity is higher fees for retail trades and limited advanced features. Its fee structure can be around 0.5% or more per trade for low-volume users on the consumer platform, but Coinbase Pro uses a maker-taker model starting around 0.4%/0.6% and reducing with volume.

In terms of security and trust, Coinbase has an edge, especially for U.S. traders – “Coinbase is well-known for being user-friendly” and has “an edge due to its regulatory compliance in the US”. It’s a solid choice to start with, or for those who prioritize a regulated environment and ease of use over the absolute lowest fees.

Many intermediate traders maintain a Coinbase account for fiat on/off ramp (converting to USD and withdrawing to bank, as Coinbase supports direct bank integrations) while doing high-frequency altcoin trading on platforms like Binance.

Special Note:

It’s worth noting that beyond these two, there are other reputable exchanges: Kraken (US-based, known for security and advanced order types), KuCoin (offshore, lots of altcoins similar to Binance), Gemini (US-based, very compliance-focused), FTX (was a major derivatives exchange until its 2022 collapse, underscoring counterparty risks), and others. Each has pros and cons. When using any centralized exchange, enable 2FA, use strong passwords, and keep only the funds there that you need for active trading.

Additionally, decentralized exchanges (DEXes) like Uniswap or SushiSwap on Ethereum, or PancakeSwap on BSC, allow trading directly from your wallet without an intermediary. DEXes are important for accessing new or very low-cap tokens not listed on major exchanges.

However, they come with their own learning curve (managing gas fees, slippage, smart contract risks). Intermediate traders might begin exploring DEXes as they venture into trading DeFi tokens, but for significant sums or frequent trading, centralized exchanges typically offer a smoother experience and better liquidity.

Below is a comparison table of the example platforms mentioned:

| Platform | Type | Notable Features / Description |

| Binance | Centralized Exchange | Hundreds of cryptocurrencies listed; very low fees (~0.1%); advanced trading options (futures, margin); complex interface but rich in tools; limited access in some jurisdictions (Binance.US for USA). |

| Coinbase | Centralized Exchange | User-friendly interface; high liquidity in major pairs; fewer altcoins supported; higher fees for low-volume traders; fully regulated and security-focused (ideal for fiat on/off ramps and beginners). |

| TradingView | Charting & Analytics | Advanced interactive charts with dozens of indicators and drawing tools; used to analyze price trends across crypto, stocks, FX; allows strategy backtesting and community-shared trade ideas; the go-to chart platform for traders (many exchanges embed TradingView charts). |

| CoinMarketCap | Market Data Aggregator | Tracks prices, market caps, volumes for all cryptocurrencies; useful for researching new coins (shows project info, explorer links, exchange listings); offers portfolio tracking and market news; not a trading venue, but an essential reference for market statistics. |

Table: Comparison of popular crypto trading platforms and tools

As the table shows, Binance and Coinbase serve as major gateways for trading, each with a different target user base, while TradingView and CoinMarketCap are indispensable tools for analysis and information. Many traders use a combination: for example, execute trades on Binance, analyze charts on TradingView, and research coins on CoinMarketCap.

Apart from these, you may also leverage mobile trading apps (most exchanges have mobile versions, and apps like Blockfolio or Delta for tracking). Some traders use algorithmic trading bots (e.g. 3Commas, HaasOnline) which can connect to exchanges via API – these require careful setup and oversight but can automate strategies like grid trading or portfolio rebalancing.

Key takeaway

choose a primary exchange that suits your needs and location, secure it properly, and get comfortable with a robust charting tool. Supplement those with data aggregators and other resources for a well-rounded toolkit. With the right platforms at your disposal, you’ll execute trades more efficiently and make informed decisions based on reliable data.

7. Regulatory Landscape and Compliance (USA, EU, Asia)

Cryptocurrency regulation is a rapidly evolving field that every trader needs to monitor. The rules can affect how and where you trade (for instance, some exchanges bar users from certain regions, and certain coins can be deemed securities and restricted). As of 2025, the regulatory landscape across major jurisdictions is as follows:

United States

The U.S. has been moving slowly towards a comprehensive crypto regulatory framework. Currently, regulation is largely done through existing agencies and enforcement actions.

The Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) have been asserting authority: for example, the SEC has pursued lawsuits against companies like Ripple (issuer of XRP), and even major exchanges like Coinbase and Binance, alleging some crypto offerings constitute unregistered securities.

In 2023 and 2024, there were landmark developments: a court ruled that Ripple’s XRP sales on exchanges did not constitute securities offerings (a partial win for crypto firms), and another court forced the SEC to reconsider (and eventually approve) the first spot Bitcoin ETFs. Indeed, January 2024 saw the approval of Bitcoin spot ETFs in the U.S., and by mid-2024, Ethereum spot ETFs as well.

These ETFs provide regulated investment vehicles for institutions and are a sign of gradual acceptance. However, U.S. crypto traders still face uncertainty: different cryptocurrencies may fall under different classifications (commodity vs security), and new legislation is pending.

Two notable bills – the Financial Innovation and Technology (FIT) for the 21st Century Act and the Stablecoin Regulation bill – have been proposed to clarify oversight, but progress has been slow. On the compliance side, U.S. traders must use exchanges that follow KYC/AML (know-your-customer/anti–money laundering) rules. Almost all reputable platforms will require identity verification for U.S. users.

Additionally, tax compliance is a major factor: the IRS treats crypto as property, meaning capital gains tax applies to trading profits. Every trade (even crypto-to-crypto) is a taxable event in the U.S. You should keep records of your trades for reporting. Don’t assume crypto is under the radar – “profitable crypto trades are taxable” and even though crypto wallets can be pseudonymous, exchanges provide 1099 forms and the IRS has increased enforcement.

On the brighter side, one current quirk is the lack of wash-sale rules (as mentioned earlier), giving U.S. traders some flexibility in tax loss harvesting – but lawmakers have eyed closing that loophole, so stay updated on tax law changes.

European Union

The EU has taken a big step forward with a unified approach through the Markets in Crypto-Assets (MiCA) Regulation. Passed in 2023, MiCA is “the world’s first comprehensive cryptocurrency regulation”.

It establishes a licensing regime for crypto service providers (exchanges, wallet providers, etc.) across all EU member states, meaning a company compliant in one EU country can passport services to others. MiCA aims to protect users and increase transparency. It imposes requirements like ensuring white papers for tokens meet certain standards and that stablecoin issuers hold adequate reserves.

Notably, from January 2026, crypto providers in the EU will have to collect identifying information for even small crypto transfers – essentially extending the financial “Travel Rule” to crypto. This means if you send crypto from your exchange account to another exchange or custodian, your name and info might be attached to the transaction data to comply with anti-money laundering rules.

Also, unhosted (self-custody) wallets won’t be outlawed, but large transactions from such wallets may require verification of ownership if above a threshold (the EU set €1000 as a guideline for extra checks).

For traders, what’s the impact? If you are in the EU, you can expect more exchanges to be legally registered and compliant. You might face slightly more KYC when moving funds around, but in return potentially get a more secure environment (less risk of exchange collapses or shady operators).

MiCA also gives legal clarity – e.g. defining asset-reference tokens, e-money tokens (stablecoins), etc., which should foster innovation under supervision.

Additionally, the EU has implemented rules like requiring crypto-asset businesses to report suspicious transactions and comply with stricter AML (Anti-Money Laundering) standards. Overall, Europe is attempting to balance innovation with oversight, and as a trader, that means more protection but also more compliance steps.

If you trade on EU-based exchanges, expect detailed terms of service explaining your rights, and likely straightforward tax reporting since many EU countries have clear crypto tax guidelines (often treating it as capital assets as well). Always consult your country’s specific tax rules though – for instance, Germany exempts crypto held over a year from tax, whereas France treats it differently, etc.

MiCA does not homogenize tax law, only the regulatory framework for businesses.

Asia

Asia’s stance on crypto is diverse, reflecting a mix of very friendly and very hostile jurisdictions.

Japan is a prime example of a pro-crypto regulatory environment. Japan recognizes cryptocurrency (like Bitcoin) as legal property and a means of payment under the Payment Services Act. Exchanges in Japan must be licensed by the Financial Services Agency (FSA) and comply with strict rules (including segregating client assets and annual audits).

After some high-profile hacks (Mt. Gox in 2014, Coincheck in 2018), Japan enforced strong security requirements. Japanese law also recently tightened the Travel Rule compliance, requiring exchanges to share customer info on transfers to tackle money laundering. For Japanese traders, this means domestic exchanges are very safe and regulated, though sometimes slower to list new tokens (due to approval requirements). Trading is legal and gains are taxed as income (which can be a high rate).

South Korea is another major player – it passed the Virtual Asset Users Protection Act (2023) to strengthen oversight. South Korea now requires exchanges to register and partner with local banks to enforce real-name verified accounts. They focus heavily on protecting investors (mandating insurance funds, disclosure, etc.).

Korean exchanges delisted many altcoins that didn’t meet transparency standards. If you trade in Korea, you’ll notice the “Kimchi premium” (prices historically higher due to capital controls) has lessened, but strict rules mean you likely need local ID to use Korean exchanges, and tax laws (a 20% tax on crypto profits was proposed, though implementation got delayed).

On the flip side, China has one of the strictest anti-crypto regimes: since 2021, China outright banned cryptocurrency trading and mining. “Exchanges, trading, and crypto mining are banned” in mainland China. As a result, Chinese exchanges relocated (e.g. Binance left China early on, Huobi moved operations overseas). Many Chinese traders turned to underground trading or moved funds via OTC and stablecoins, but officially it’s illicit. Notably though, China is pro-blockchain in other ways (it launched a digital yuan CBDC and uses blockchain for trade finance).

Hong Kong (a special region) by 2023-2024 has been opening up to licensed crypto trading for retail, marking a possible regulated gateway within China’s sphere.

Singapore is another hub: it welcomes crypto businesses but with robust licensing under the Monetary Authority of Singapore (MAS). Singapore requires exchanges (called Digital Payment Token services) to be licensed and comply with AML/CFT rules. It banned advertising crypto to the public to curb retail speculation, but trading itself is legal. Many crypto companies base in Singapore for its clear regulations and tax advantages (no capital gains tax).

India has had a tumultuous approach: after overturning a central bank ban in 2020, India imposed stiff taxes (30% on crypto gains, and 1% TDS tax on every transaction in 2022) which dampened trading volumes. No comprehensive regulation bill has passed yet (a draft that would have banned crypto again has stalled), but the government launched its own digital rupee. Indian traders currently face heavy tax burdens and must use domestic exchanges under strict banking oversight.

In Southeast Asia, many countries like Thailand, Malaysia, Indonesia have introduced exchange licensing and investor protection laws (Thailand regulates crypto under its SEC with restrictions on advertising; Indonesia allows trading via licensed brokers and is working on a national exchange). Vietnam and Philippines have growing adoption but are still ironing out laws.

What does this mean for you as a trader?

- Know the rules in your jurisdiction. Ensure the exchange you use is allowed in your country (for example, U.S. persons shouldn’t use Binance.com due to legal restrictions; similarly, if you’re in China, accessing off-shore exchanges is technically illegal). Comply with tax reporting – crypto’s pseudonymous nature is not immunity from law. Many countries now have agreements to trace and share crypto transaction info (the OECD’s CARF framework is coming, akin to FATCA for crypto). If privacy is a concern, be aware that regulations like the Travel Rule mean your personal info might be attached to certain transactions above thresholds, reducing anonymity.

- On a positive note, clearer regulation is beneficial for long-term growth – it can lead to more institutional participation (meaning more liquidity) and products like ETFs, and reduce the risk of sudden legal crackdowns. As an intermediate trader, staying informed on the regulatory news is important. For instance, an announcement that the SEC will classify certain tokens as securities could drastically affect those token’s prices and exchange listings. Or if a country legalizes crypto trading, it might open arbitrage opportunities or new markets.

- Practical compliance tips: Always do KYC where required – getting verified on an exchange early prevents issues later (and enables higher withdrawal limits). Keep records of your trades (most exchanges let you export trade history) to make tax filing easier. Consider using portfolio trackers or crypto tax software that integrates with exchanges to calculate gains/losses. If you value privacy, look into decentralized exchanges, but understand the legal implications if your country doesn’t allow them. And never assume that because crypto operates on the internet, it’s lawless – governments have repeatedly proven they can enforce regulations, whether through fintech companies or internet service controls.

8. Strategies for Top Cryptocurrencies: Bitcoin, Ethereum, USDT, and PHI

Not all cryptocurrencies are created equal. Each of the “top” coins has its own market dynamics and requires a tailored trading approach. Here we provide specific analysis and strategy considerations for four prominent cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and PHI Token (PHI).

Bitcoin (BTC)

Bitcoin is the largest cryptocurrency, often dubbed “digital gold.” It accounts for roughly half of the entire crypto market’s capitalization, and its price movements set the tone for the market.

Analysis

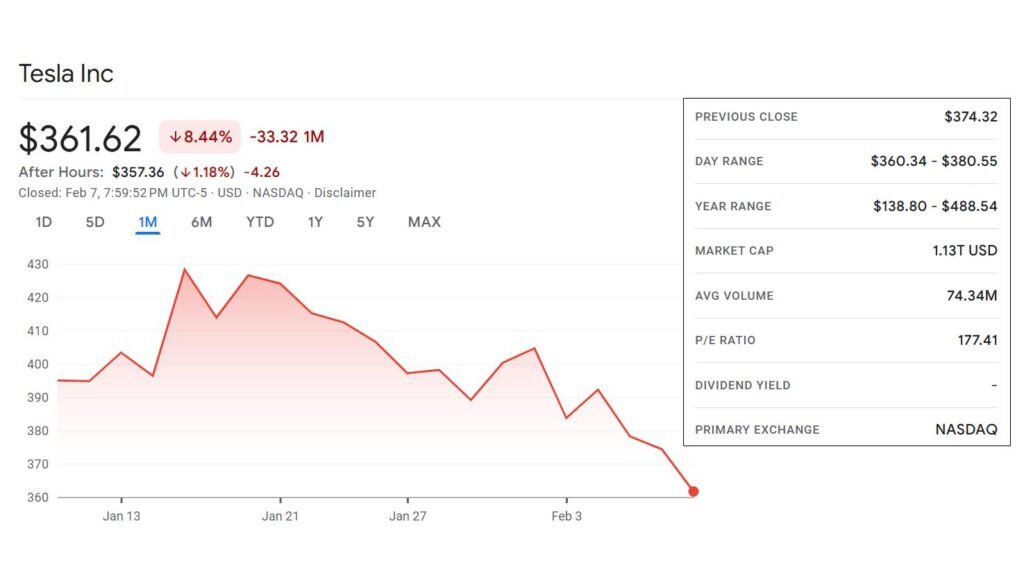

Bitcoin tends to be comparatively less volatile than altcoins, but still highly volatile relative to traditional assets. Its price is influenced by macroeconomic trends (interest rates, inflation concerns can drive a “flight to quality” into BTC or out of it), by network adoption (e.g. more institutions or countries adopting Bitcoin), and by its 4-year halving cycle.

Historically, Bitcoin has experienced bull runs in the year or two after each halving (which cuts new supply issuance – the latest was in April 2024), followed by bear markets.

Traders watch metrics like Bitcoin’s stock-to-flow, mining hash rate (which reflects network security and miner confidence), and Bitcoin dominance (BTC’s share of total market cap) to gauge its strength.

Strategy

Many traders treat BTC as a core long-term holding and a benchmark for gauging when to rotate into altcoins. A common strategy is dollar-cost averaging into Bitcoin on dips and simply holding – this has proven effective for those with a multi-year horizon, as Bitcoin’s trajectory has been up over the long term despite severe drawdowns. For active trading, Bitcoin is favored for swing trades and even day trades because of its deep liquidity and relatively predictable technical patterns. It often respects key support/resistance levels (like round numbers $20k, $30k, etc., or prior cycle highs).

Traders might use trend-following strategies during established uptrends (e.g. buy pullbacks to the 50-day MA in a bull market) and range strategies when it’s consolidating.

Shorting Bitcoin during downtrends is also common via futures, as hedging or speculation, but one must be cautious of sharp short squeezes. Since BTC is less prone to random 80% pumps than small altcoins, leverage is sometimes used more (within reason) by traders to amplify the slower moves.

Key tip

Pay attention to Bitcoin news – ETF approvals, regulatory news specifically about Bitcoin (like legal tender news), or large hodlers moving coins can all impact price. Also, Bitcoin is the trading pair for many altcoins (on exchanges that use BTC markets), so BTC’s movements can inverse-correlate with altcoins: in Bitcoin bull runs, smaller alts sometimes lag (as money piles into BTC), whereas when Bitcoin stabilizes, traders rotate into alts (the phenomenon of “altseason”).

An intermediate trader in Bitcoin will often also keep an eye on global markets (stocks, dollar index) for macro correlation – e.g., BTC has at times moved with tech stocks or inversely with the USD. Overall, BTC’s large market and broad adoption make it somewhat akin to a “blue chip” – it’s a staple in portfolios, and trading it successfully often means capturing the broad market swings and not over-leveraging on noise.

Ethereum (ETH)

Ethereum is the second-largest crypto and the leading smart contract platform. Its blockchain underpins the majority of DeFi and NFT activity.

Analysis

Ethereum’s value is driven by both macro factors (it often correlates with Bitcoin’s direction, though with higher beta) and platform-specific factors: network usage (high transaction volumes and fees can signal demand), technological upgrades (such as the successful “Merge” to Proof-of-Stake in 2022, which turned ETH into a yield-bearing asset via staking), and competition from other Layer-1 chains.

Ethereum’s monetary policy has evolved – with EIP-1559 fee burns and Proof-of-Stake, ETH can become deflationary when network activity is high (meaning more ETH is burned as fees than issued as rewards). Indeed, there have been periods post-2022 where Ethereum’s supply growth turned negative, effectively making ETH scarcer with use.

Traders monitor metrics like gas fees (high gas implies network congestion, users paying a premium – often bullish if sustained), staking rates (a lot of ETH locked in staking reduces circulating supply), and DeFi total value locked (TVL) on Ethereum as a health barometer.

Strategy

Ethereum is often seen as a higher volatility play than Bitcoin – in bull markets, ETH tends to outperform BTC in percentage terms (for example, in 2020–2021, ETH’s gains outpaced BTC’s), but in bear markets it can also draw down more. Many traders trade the ETH/BTC pair to capture this relative performance: e.g. rotating into ETH when ETH/BTC is in an uptrend (meaning ETH is gaining vs BTC), and rotating back to BTC when ETH/BTC momentum fades.

On shorter time frames, Ethereum technical analysis works similarly to Bitcoin’s, but keep in mind ETH can be more news-sensitive around upgrades (e.g., the anticipation of the Shanghai upgrade enabling staking withdrawals in 2023 affected price). One strategy some intermediate traders use is options trading on ETH, since it has a growing options market (on Deribit and CME) – for example, selling call options during periods of exuberance to earn premium, or buying protective puts before major unlock events.

For simpler approaches, swing trading ETH by buying on oversold conditions during fundamentally strong periods works (for instance, if ETH’s RSI is very low but you know a major NFT launch or DeFi protocol is driving usage, it could rebound sharply).

Ethereum also has seasonal patterns – historically, it has strong periods when new trends (like ICOs in 2017, DeFi summer in 2020, NFTs in 2021) drive demand. Recognizing those narrative cycles can inform your trading (buying early in a new hype cycle, taking profit before the hype cools). With the introduction of futures ETFs for ETH in 2024 and potentially more institutional products, Ethereum is cementing itself alongside BTC as a must-watch asset.

Risk note

Gas fees volatility – during extreme network congestion, using ETH (or trading ERC-20 tokens) can become very expensive, which sometimes actually cools down trading activity on Ethereum-based DEXes and can indirectly affect demand for ETH.

Layer-2 adoption (Arbitrum, Optimism) might change how directly network usage translates to ETH price (since some activity moves off-chain). But generally, ETH’s role as the backbone of decentralized finance means its fortunes rise with the broader crypto ecosystem’s growth. Trading ETH often requires juggling both BTC-like analysis and unique Ethereum ecosystem insight.

Tether (USDT)

Tether is the largest stablecoin, pegged 1:1 to the US Dollar. While not an investment for price appreciation, USDT plays a critical role in trading strategy as a liquidity and risk management tool.

Analysis

USDT’s value is designed to remain $1. Traders don’t analyze it for upside but for stability and any signs of risk to the peg. USDT is issued by Tether Ltd., which holds reserve assets. Over the years, Tether has faced scrutiny about its reserves’ transparency.

Periodically, news or rumors surface about Tether’s solvency – during such times, USDT may briefly trade below $1 (as some investors flee to other stablecoins). However, Tether has maintained its peg through various market stresses, and as of 2024, it’s “the most traded cryptocurrency” by volume, often exceeding Bitcoin’s trading volume.

Traders should keep an eye on Tether’s quarterly attestations, any legal/regulatory developments (e.g. in 2021 Tether settled with the NY Attorney General and agreed to provide reserve breakdowns), and overall stablecoin market health.

Strategy

From a trading perspective, you use USDT (or similar stablecoins like USDC) as the safe haven leg of trades. For example, if you expect a market downturn, you might sell crypto holdings into USDT to preserve capital (since 1 USDT should hold value at $1 while cryptos drop).

In a way, going to USDT is going to cash in crypto terms. Many exchanges denominate trading pairs in USDT (e.g. ETH/USDT), so it’s the base currency for trading altcoins. An intermediate trader might adopt a strategy of increasing their stack of USDT in bear markets and deploying USDT during dips in bull markets.

Arbitrage and Yield

There are sometimes arbitrage opportunities involving USDT – for instance, if USDT de-pegs slightly (trading at $0.98), savvy traders might buy it cheap and redeem directly with Tether Ltd. or trade it when it recovers to $1 (this typically requires large capital and access to redemption facilities, so mainly arbitrage firms do it).

Additionally, USDT (like other stablecoins) can be lent out on various platforms for interest. During bull markets, demand to borrow USDT to leverage up can spike, letting lenders earn high yields. Traders with excess USDT might lend it on credible venues (mind counterparty risk) to earn a yield instead of letting it sit idle. That said, the yield on major stablecoins has fluctuated and come down as markets matured.

Risk management use

Many intermediate traders set aside a portion of their portfolio in USDT or other stablecoins at all times. This not only hedges against market crashes but also provides dry powder to buy dips. A concept of a stablecoin portfolio ratio is common – e.g. you might decide always to keep 30% in stablecoins and 70% in crypto, shifting that ratio more towards stablecoins if market enters a downtrend.

Caution

Even though USDT is stable, it’s not FDIC-insured cash; there’s a trust element that the peg holds. Diversifying stablecoins (split between USDT, USDC, BUSD (though BUSD is phasing out by 2024), DAI, etc.) can mitigate risk if one coin has an issue.

Also, note that certain platforms or countries have restrictions on Tether (for example, some banks won’t process transfers related to Tether due to past legal concerns).

Generally though, Tether’s ubiquity – especially in Asia – makes it a cornerstone of crypto trading. In fact, in markets like futures trading, many contracts use USDT as collateral. So a trader might deposit USDT on a futures exchange to long or short various coins without touching fiat.

In summary, USDT strategy is about how to use stablecoins effectively: allocate to USDT during uncertain times, use it as your quote currency for alt trades, and watch for any rare signs of peg instability (which are usually arbitrage opportunities). Think of USDT as the “cash reserve” in your trading arsenal – boring but vital.

PHI Token (PHI)

PHI is an example of a small-cap cryptocurrency. (For context, PHI Token operates on Ethereum and has a modest circulating supply – CoinMarketCap shows ~5.8 million PHI in circulation and a price in the few-cent range, which implies a market cap well under $1 million – extremely small). Trading such a low-cap token is a different ballgame compared to BTC or ETH.

Analysis

Low-cap tokens like PHI often have limited liquidity, large spreads, and can be subject to sharp pumps and dumps. Price may move more on speculation or a single whale’s actions than on broad market trends.

It’s crucial to research the fundamentals

What is PHI Token’s project about (visit their website, read whitepaper)? Is there an active development team or community? With micro-caps, due diligence is paramount to avoid scams or dead projects. Even if the project is legitimate, small caps are very sensitive to news (a single exchange listing or partnership can send it soaring, while a negative development or prolonged silence can tank it).

Also check the distribution: if one wallet holds a huge portion of supply, that’s a risk (they could dump).

Strategy

Trading PHI or similar tokens requires caution and strict risk management. First, limit position size – only a small part of your portfolio should go into such a high-risk asset. Because the trade might not always be liquid, using a market order can cause slippage; it’s often wise to use limit orders and be patient to get filled near your desired price.

Volatility can be extreme

PHI could jump 50% in a day on low volume and drop just as fast. One strategy is to capitalize on momentum when volume spikes (often driven by a catalyst like a new exchange listing or social media attention), but take profits quickly and don’t be greedy.

Since technical patterns are less reliable in thin markets, some traders rely on a combination of news monitoring and community sentiment. For example, being active in PHI’s Telegram or Discord might give early heads-up on developments. You might also set alerts on social platforms for mentions of PHI.

Remember the principle that “low-cap altcoins present high-reward opportunities but come with massive volatility and susceptibility to manipulation”. In practice, that means you might see coordinated pump groups target PHI – as an informed trader, either avoid those scenarios or if you participate, have a clear exit plan (don’t be left as the bag holder when the pump ends).

Another strategy is accumulation on weakness: if after research you believe in PHI’s long-term potential, you could accumulate slowly when price is flat and nobody is talking about it (placing small buys over time). However, with so many micro-caps out there, only a few will survive or thrive, so this is more akin to venture investing than trading – extremely high risk.

Risk management

Use stop-losses if possible, though note that low volume can sometimes blow through stops without fills. An alternative is a mental stop – if PHI falls X% below your entry and volume is dead, you manually exit.

Also, be aware of exit liquidity – when you want to sell, will there be buyers? It’s not always easy to offload a large PHI position without tanking the price. So, you might have to exit in tranches. Keep an eye on order book depth (on whatever exchange or DEX PHI trades; many such tokens are on decentralized exchanges like Uniswap). If only a few thousand dollars of liquidity exists at each price level, you simply cannot execute big trades at once.

Summary strategy for PHI

trade it with a speculative mindset – perhaps allocate a small amount, aim for a multiple (2x, 5x) if things go well, and be ready to cut losses entirely if the project shows red flags. Consider any money in such micro-caps as venture capital: you might either hit a big winner or lose most of it. And importantly, stay updated: follow PHI’s announcements closely.

If suddenly the project releases a major update or exchange listing, that could be your moment (the price may react quickly, but often there’s an initial spike then a retracement – sometimes buying the rumor and selling before the news hits is a tactic). Conversely, if developers abandon the project (no updates for months), it’s often best to exit and free your capital for better opportunities.

Conclusion:

In essence, Bitcoin and Ethereum are suitable for both long-term investing and active trading, with large markets that respond to both crypto-specific and macro factors.

USDT isn’t traded for profit, but strategically used to manage portfolio risk and seize opportunities in volatile markets.

PHI and similar small-caps represent the high-risk, high-reward end of the spectrum – they require careful analysis and nimble trading to profit from, and one should never risk more than one can afford to lose on these

A balanced approach for an intermediate trader might be: have the majority of your capital in majors like BTC and ETH (which you trade or invest in using the strategies discussed, benefiting from their relatively more predictable behavior and strong long-term uptrend) and maintain a portion in stablecoins (USDT) to deploy or to hedge.

Then, allocate a small slice to speculative plays like PHI – treating them like lottery tickets or experimental trades. This way, the core of your portfolio is solid, and you still have exposure to potentially explosive gains without jeopardizing everything.

Always remember to reevaluate strategies per coin as conditions change. What works in a bull market (e.g. hold ETH and ride it up) might not in a bear market (where perhaps shorting BTC or sitting in USDT is better). And when a small-cap like PHI actually succeeds and grows in market cap, it might graduate to a different style of trading. Staying flexible and applying the appropriate strategy to each asset is the hallmark of a seasoned trader.

Become a Pro in Crypto Trading!

Trading cryptocurrencies at an intermediate level involves juggling many pieces – market principles, personal psychology, technical tools, evolving regulations, and the unique behavior of different coins. By grounding yourself in solid rules, maintaining best practices in strategy and risk management, leveraging technical and fundamental analysis, using the right platforms, staying compliant, and tailoring your approach to each asset, you’ll be well-equipped to thrive in the crypto markets.

The crypto space is ever-changing; continue to learn and adapt. With diligence and discipline, you can capitalize on the opportunities in this exciting asset class while prudently managing the risks. Good luck and happy trading!