|

Getting your Trinity Audio player ready...

|

Around the world, many economies face an increasingly familiar dilemma: economic stagnation coupled with ballooning fiscal pressures. For policymakers, the pressing question isn’t simply how to survive a downturn, it’s how to emerge from one without saddling future generations with crippling debt.

In this article, we delve into strategic, innovative macroeconomic techniques designed to stabilize and reinvigorate a struggling economy—without expanding national borrowing.

Stay with us until the end to understand how a country can turn recession into resurgence through smart, debt-neutral measures. For more insights, visit Thinquer regularly, and don’t forget to leave us a comment—your perspective matters.

I. Smart Spending: The Efficiency Revolution

When debt is not an option, governments must make every currency unit count through bold efficiency gains and targeted resource allocation.

A. Streamlining the Public Sector

Picture a house cluttered with unnecessary furniture. Each piece consumes valuable space, offering little in return. Similarly, bloated government structures burden taxpayers without proportionate benefits.

By reducing overlaps among agencies, digitizing administrative processes, and implementing shared-services models, a nation can significantly lower costs. Estonia’s success story is inspiring. The country embraced digital governance early, cutting administrative expenses by up to 15% while improving public services.

B. Strategic Budget Allocation

Still, it’s not just about cuts; it’s about smart investments. Redirecting resources from low-impact programs to sectors that drive productivity—like infrastructure, research, and vocational training—can multiply the value of each currency unit.

Finland offers a good example: it redirected spending toward high-quality vocational education, reducing youth unemployment and laying a foundation for sustained growth.

II. Revenue Growth Without New Taxes

Generating more government revenue doesn’t always require raising tax rates—it often starts with collecting smarter and wider.

A. Closing Loopholes and Broadening the Base

Fiscal efficiency often starts with plugging leaks. Tax loopholes, narrow exemptions, and evasions act like holes in a bucket. Through better enforcement and digital tools, countries can raise revenue without altering tax rates.

A digital VAT tracking system, for example, can increase revenues by billions over a short period, as seen in multiple national case studies. This proves the power of tech in fiscal policy.

B. Smart Use of User Fees

User-based pricing aligns payment with usage. Charging for highway access, waste management, or business permits ensures that those who benefit most contribute proportionately.

Toll reforms and market-based utility pricing in several countries have shown that smart user fees can enhance both revenue and service quality.

III. Leveraging Public-Private Partnerships (PPPs)

Accessing private capital through strategic cooperation offers a powerful way to invest in national priorities without inflating sovereign debt.

A. Infrastructure without Borrowing

Imagine renovating your home through a partnership: the contractor shares the cost and is paid later from revenue generated. That’s the essence of PPPs. These agreements allow private capital to build and manage infrastructure, with governments repaying over time through service fees or leases.

This model has worked in sectors such as transportation, healthcare, and urban utilities around the globe.

B. Asset Recycling and Monetization

Governments can generate funds by leasing or selling underused public assets, then reinvesting the proceeds into growth-oriented projects.

Airport concessions, land leases, and utility privatizations have helped multiple governments inject liquidity into their economies while improving efficiency.

IV. Structural Reforms for Sustainable Growth

Long-term prosperity depends on unlocking structural efficiency—making labor markets and business ecosystems more productive and resilient.

A. Labor Market Activation

Transforming unemployment aid into active job-seeking support—through training, job placement, and contract flexibility—boosts workforce participation and reduces fiscal strain.

Countries that implemented active labor market policies have seen reductions in long-term unemployment and increased labor productivity.

B. Business-Friendly Regulation

Red tape is growth’s biggest enemy. Removing bureaucratic hurdles, simplifying registration, and digitizing licensing can unleash business creation and attract foreign investment.

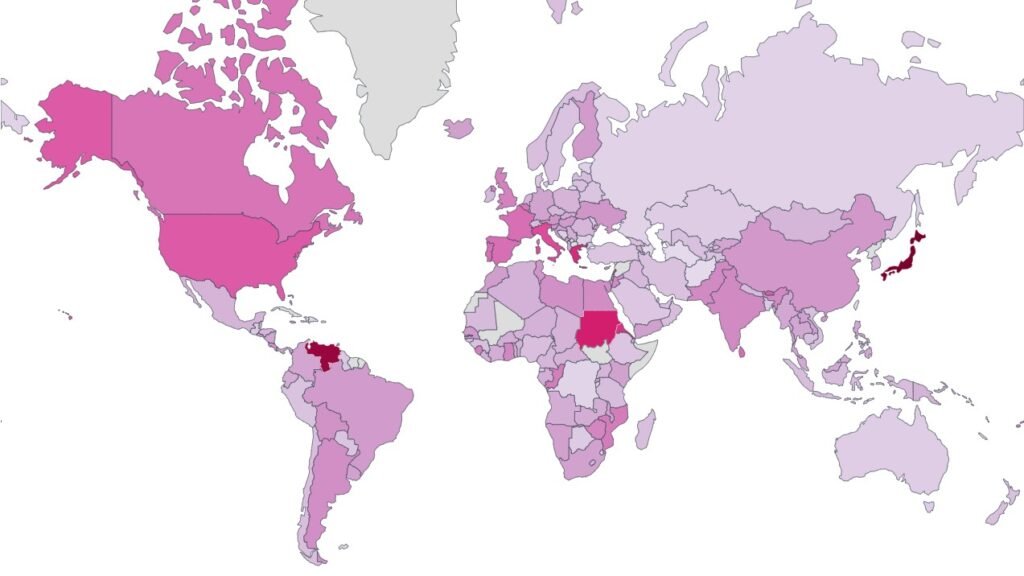

Regulatory simplification programs have proven to expand the tax base and improve competitiveness in markets from Asia to Latin America.

A Future-Proof Fiscal Playbook

Navigating a recession without growing debt is tough, but entirely possible. A combination of smarter public spending, broadened revenue collection, strategic partnerships, and meaningful reforms offers a clear way forward.

This isn’t just economic theory—these are proven tools, backed by examples from across the globe. Have you considered which of these strategies would work in your country?

Join the conversation in the comments, and check back at Thinquer for more sharp economic storytelling.