|

Getting your Trinity Audio player ready...

|

🧐 Insights from the 2024 Global Debt Report

As global economies grapple with inflation, economic downturns, and geopolitical tensions, national debt levels continue to be a major concern for governments and financial analysts alike. The debt-to-GDP ratio is a key indicator of a country’s economic health, showing the proportion of a nation’s debt relative to its gross domestic product (GDP). A higher percentage implies a greater reliance on borrowed money, potentially affecting economic stability and growth prospects.

According to data from the IMF published on Wikipedia, several nations have seen their debt burdens skyrocket in recent years. Let’s dive into the top countries by national debt-to-GDP ratio, analyzing the economic implications and key factors driving these figures.

What is the Debt-to-GDP Ratio?

The debt-to-GDP ratio is a key economic indicator that measures a country’s total government debt as a percentage of its Gross Domestic Product (GDP). This ratio provides insight into a nation’s ability to manage and repay its debt by comparing its financial obligations to the size of its economy. A lower debt-to-GDP ratio suggests that a country produces enough economic output to manage its debts efficiently, whereas a higher ratio can indicate financial instability and an increased reliance on borrowing.

Governments accumulate debt by issuing bonds or taking loans to finance budget deficits, infrastructure projects, public services, or economic stimulus measures. While debt itself is not necessarily problematic, excessive debt relative to GDP can lead to economic risks such as rising interest costs, inflationary pressures, and potential default crises.

Economists and policymakers analyze the debt-to-GDP ratio to assess a country’s fiscal health, determine creditworthiness, and evaluate policy decisions. Countries with a sustainable debt-to-GDP ratio typically have strong economic growth, disciplined fiscal policies, and stable financial markets.

How to Calculate the Debt-to-GDP Ratio?

Calculating the debt-to-GDP ratio is straightforward and involves a simple formula:

Debt-to-GDP Ratio (%) = (Total Government Debt / Gross Domestic Product) × 100

- Total Government Debt: This includes all outstanding debt liabilities of a country’s central and local governments. It may consist of domestic and foreign borrowings in the form of bonds, loans, or other financial instruments.

- Gross Domestic Product (GDP): The GDP represents the total value of goods and services produced within a country over a specific period, typically measured annually.

For example, if a country has a total government debt of $2 trillion and a GDP of $10 trillion, the debt-to-GDP ratio would be:

(2 trillion / 10 trillion) × 100 = 20%

A lower ratio suggests that the country’s economy is growing faster than its debt, while a higher ratio can indicate excessive borrowing relative to economic output. Countries with very high debt-to-GDP ratios may face difficulties in meeting debt obligations and could be at risk of economic instability or default.

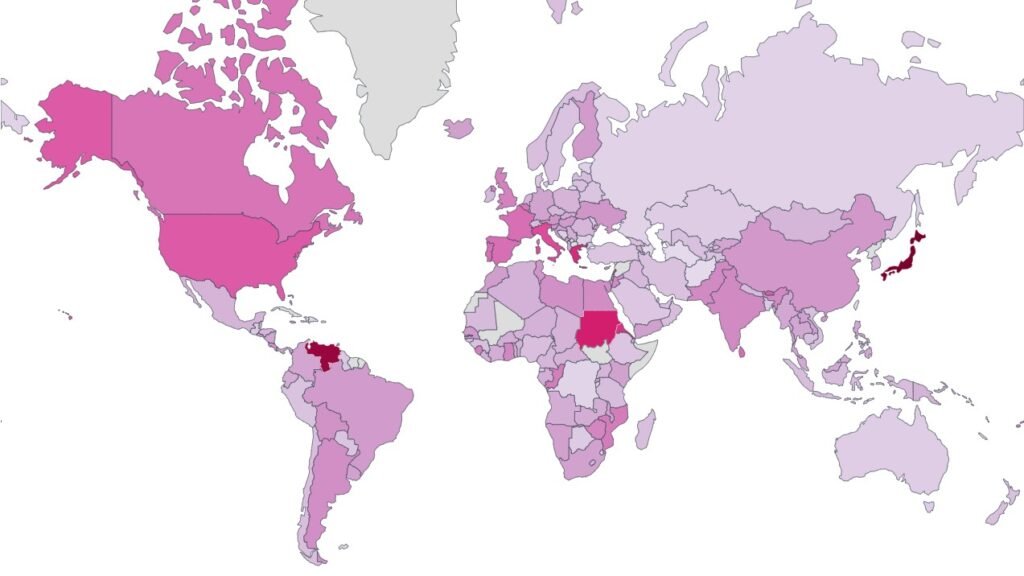

🚨 The World’s Most Indebted Nations in 2024

Among the nations with the highest debt-to-GDP ratios, some surpass their annual economic output in debt, raising concerns about financial sustainability. As per the latest data:

- Sudan holds the highest debt-to-GDP ratio, at 344.4%, largely due to economic instability and long-term financial mismanagement.

- Japan, known for its extensive fiscal stimulus programs, has a debt-to-GDP ratio of 251.2%.

- Singapore reports a debt ratio of 175.2%, a result of financial structuring.

- Greece, still recovering from financial crises, maintains a debt level of 159.0%.

- Venezuela, struggling with hyperinflation and economic collapse, sees its debt at 159.2% of GDP.

- Eritrea has a debt-to-GDP ratio of 152.5%, influenced by years of economic isolation.

- Lebanon carries a debt ratio of 151.2%, exacerbated by political instability.

- Italy maintains a debt-to-GDP ratio of 136.9%, dealing with slow economic growth.

- United States has a debt-to-GDP ratio of 121.0%, driven by substantial borrowing and spending policies.

- Portugal rounds out the top ten, with a debt ratio of 94.7%, reflecting the impact of long-term fiscal imbalances.

The data indicates that developed economies, particularly in Europe and Asia, tend to have higher debt ratios, often due to extensive public welfare programs and economic stimulus measures.

✅ The World’s Lowest Debt Nations in 2024

On the opposite end of the spectrum, some nations have managed to maintain exceptionally low debt-to-GDP ratios, reflecting disciplined fiscal policies, resource wealth, or limited government borrowing. Here are some of the countries with the lowest national debt:

- Macau maintains a debt level of 0.0%, thanks to strong financial management and casino-driven economic revenues.

- Brunei has one of the lowest debt-to-GDP ratios, at 2.3%, due to substantial oil and gas revenues that support government expenditures.

- Turkmenistan enjoys a debt-to-GDP ratio of around 4.7%, reflecting strong fiscal discipline.

- Tuvalu has managed to keep debt under 7.0%, largely due to small-scale economic strategies.

- Kuwait maintains low debt, around 7.1%, benefiting from strict fiscal policies.

- Hong Kong has a debt level of 9.0%, benefiting from a strong financial sector and conservative fiscal policies.

- Taiwan follows strict debt policies, keeping its debt levels at 22.5%.

- Estonia has controlled its debt at around 23.0%, supported by effective economic policies.

- Saudi Arabia keeps its debt manageable at 27.5%, leveraging oil wealth and financial prudence.

- United Arab Emirates, despite significant government spending, maintains a relatively low debt-to-GDP ratio of 30.3%, offset by its sovereign wealth and economic diversification strategies.

These countries demonstrate how careful financial management, diversified economies, and resource wealth can contribute to sustainable debt levels and long-term economic stability.

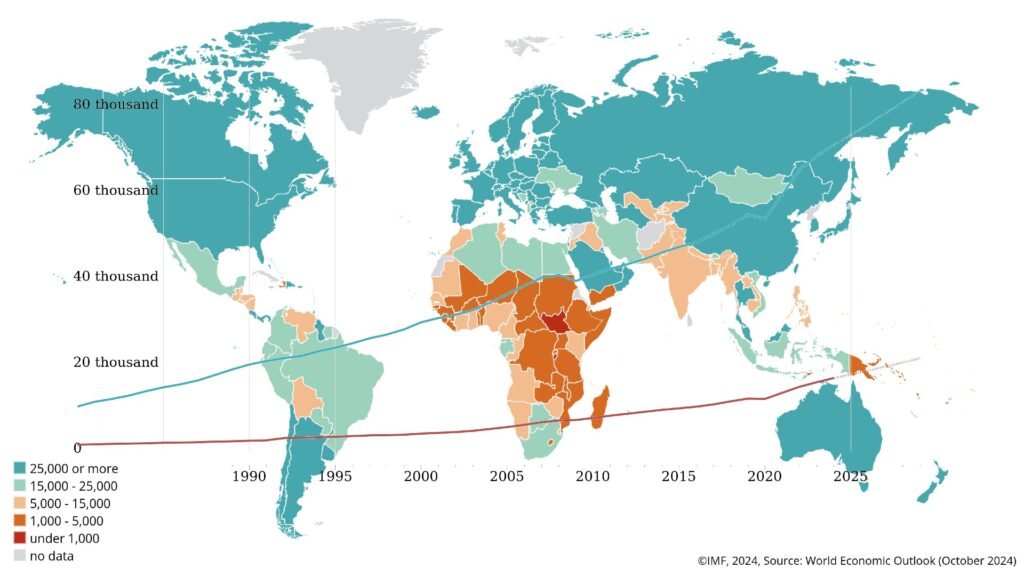

Debt Trends in Emerging Economies

While wealthier nations maintain high debt levels, emerging economies face their own challenges. Countries such as Brazil, South Africa, and Argentina struggle with rising debt due to inflation, currency devaluation, and political uncertainty. Many developing nations rely on external borrowing from the International Monetary Fund (IMF) and World Bank, further complicating their financial stability.

- Argentina, with a debt-to-GDP ratio of 86.2%, continues to navigate debt restructuring agreements and high inflation.

- Egypt, which recently secured IMF loans, has seen its debt rise to 96.4%.

- Pakistan and Sri Lanka are facing liquidity crises, with debt ratios of 71.8% and 78.6%, respectively, requiring urgent economic reforms.

Economic Risks of High Debt-to-GDP Ratios

A high debt-to-GDP ratio can lead to severe economic consequences, including:

- Rising Interest Payments: Countries with excessive debt must allocate a significant portion of their budget to servicing interest payments, limiting funds for essential services like healthcare and infrastructure.

- Inflationary Pressures: Governments resorting to printing money to cover debt obligations often trigger inflation, as seen in Venezuela and Zimbabwe.

- Weakened Currency Value: Countries burdened with high debt may experience depreciating currency values, affecting imports and overall economic stability.

- Risk of Default: When nations struggle to meet debt obligations, they risk defaulting, as witnessed in Sri Lanka’s 2022 crisis.

Can High Debt Be Sustainable?

While a high debt-to-GDP ratio is often a red flag, it does not always spell economic disaster. Countries like Japan and the United States maintain high debt levels but benefit from strong investor confidence and stable financial systems. The key factors in determining debt sustainability include:

- Economic Growth Rates: If a nation’s GDP grows faster than its debt, the burden becomes more manageable.

- Government Fiscal Policies: Prudent spending and efficient tax collection can offset high debt levels.

- Investor Confidence: Nations with strong institutional frameworks and transparent policies often retain access to financial markets despite high debt ratios.

Looking Ahead: The Future of National Debt

With rising inflation, global interest rate hikes, and economic uncertainties, many nations will need to reassess their debt strategies. Governments must balance economic stimulus with fiscal responsibility to prevent debt crises. The coming years will be crucial in determining whether countries can sustain their debt levels or if the world will face a new wave of financial instability.

As we continue to monitor global debt trends, we invite our readers to share their thoughts. Do you think high national debt levels pose a serious threat to global economic stability? Leave a comment below and let us know your perspective. Stay tuned for our ongoing coverage of economic and financial trends—check in with us daily for the latest insights.