|

Getting your Trinity Audio player ready...

|

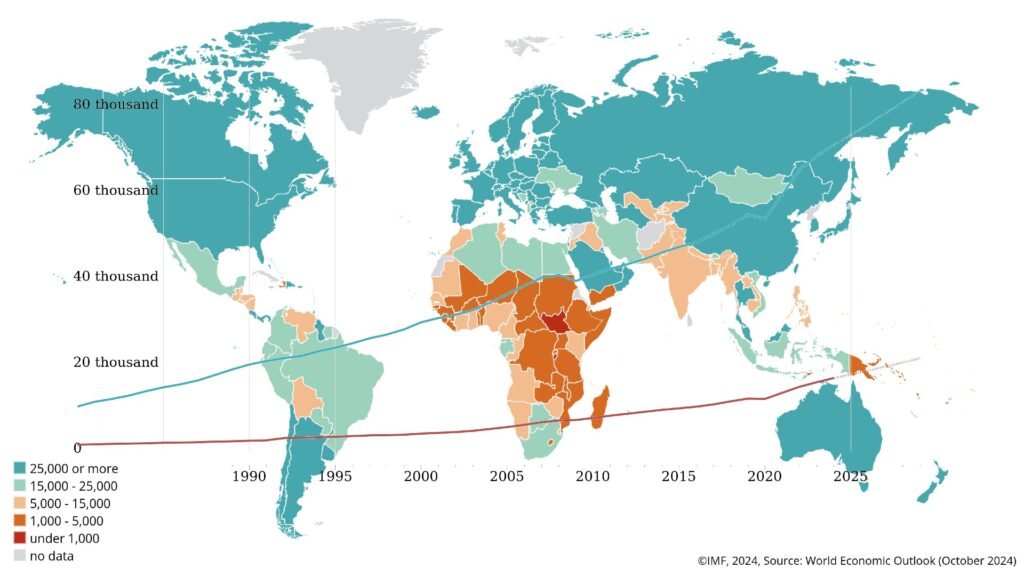

The United Kingdom’s economic trajectory for 2024 and 2025 highlights a steady path of recovery, growing confidence, and strengthening opportunities. According to the latest forecasts from the International Monetary Fund (IMF) and key financial analysts, the UK is on track to be one of the best-performing G7 economies by 2025. With improving stability in inflation, evolving monetary policies, and increasing global engagement, the UK is positioning itself for sustained prosperity.

2024 Economic Performance: Encouraging Growth and Resilience

The UK economy demonstrated steady progress in 2024, with GDP expanding by approximately 0.9%, marking a significant improvement from the 0.4% growth recorded in 2023. The final quarter of 2024 saw a positive increase of 0.1%, demonstrating resilience and adaptability. December’s economic activity was particularly strong, with a 0.4% boost fueled by vibrant consumer spending during the festive season.

Sectoral analysis shows that services and construction contributed positively, reinforcing the UK’s economic foundation. While the manufacturing sector faced challenges, the nation’s focus on innovation and adaptive supply chain strategies is paving the way for a stronger recovery. Business investment is expected to rebound as economic conditions stabilize, fostering a promising environment for future growth.

With these developments, the UK’s economic expansion in 2024 surpassed the eurozone’s stagnation and remained competitive with the United States’ quarterly expansion rate of 0.5%.

2025 Growth Projections: Momentum Building for a Brighter Future

Looking ahead to 2025, the IMF projects that the UK will achieve a top 3 growth rate among G7 economies. The UK’s GDP is expected to rise by 1.5% in 2025, reflecting a strengthening economic climate and a growing sense of optimism.

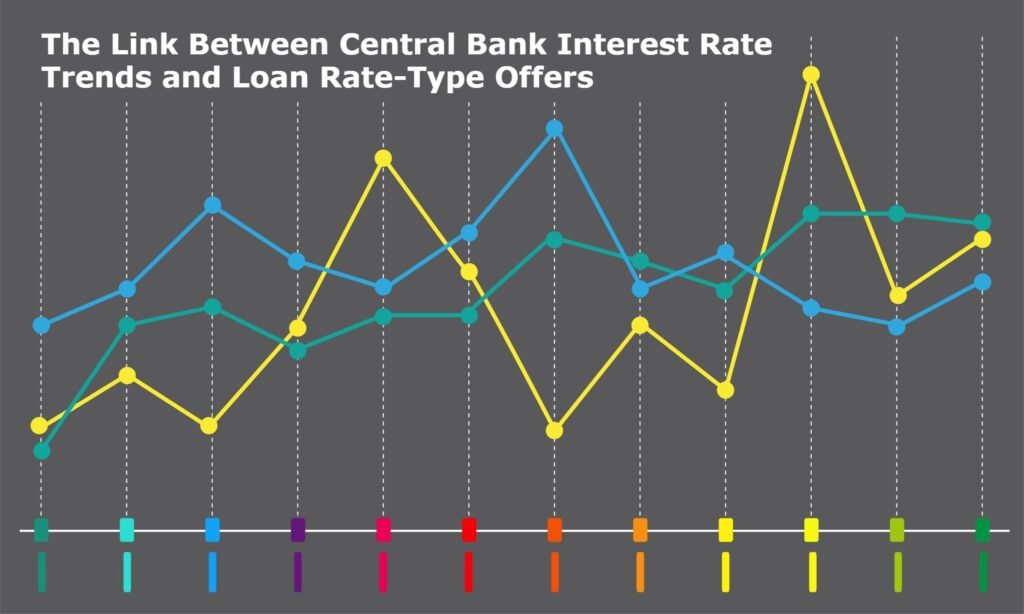

This expansion will be fueled by declining inflationary pressures, with the Bank of England poised to implement well-balanced interest rate cuts after a period of monetary tightening. Inflation, which peaked at 11.1% in 2022, is anticipated to stabilize closer to the central bank’s 2% target by mid-2025. Lower interest rates will provide a positive boost to businesses and households, increasing investment and consumer confidence.

Key Economic Drivers and Opportunities

Several factors will shape the UK’s promising economic trajectory over the next two years:

- Monetary Policy: The Bank of England’s strategic interest rate management will support sustained growth while keeping inflation in check.

- Consumer Spending: Real wage growth and a steady decline in inflation will drive consumer confidence and spending, reinforcing economic activity.

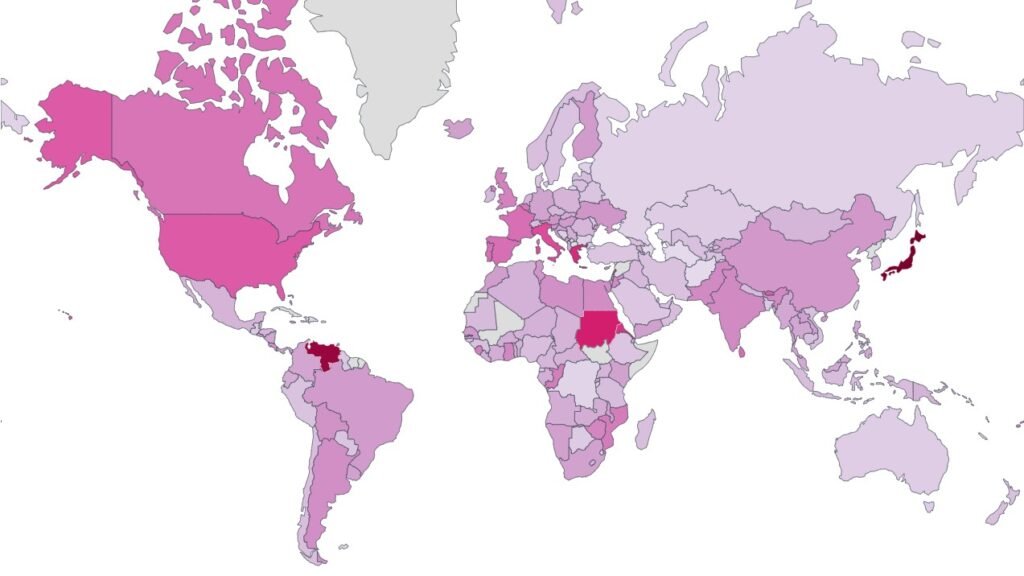

- Global Trade and Investment: The UK’s evolving trade partnerships and its attractiveness to foreign direct investment will enhance economic competitiveness.

- Innovation and Sustainability: Advances in technology, renewable energy, and infrastructure projects will stimulate new economic opportunities.

- Stronger Ties with the EU: Speculation continues regarding the UK’s potential efforts to strengthen its relationship with the European Union. Increased collaboration or a potential reintegration could open doors to new trade advantages and economic growth.

A Positive Outlook for the UK Economy

The UK economy is well-positioned for a bright and stable future, with significant opportunities for growth in 2025. With strong economic fundamentals, prudent monetary policies, and a focus on innovation, the nation is set to outperform many of its European counterparts. The IMF’s optimistic projection for 2025 reaffirms the UK’s potential for sustained economic expansion.

We invite you to share your thoughts on the UK’s economic outlook in the comments below. Stay updated with us daily for the latest financial news and insightful analysis of global economic trends.