|

Getting your Trinity Audio player ready...

|

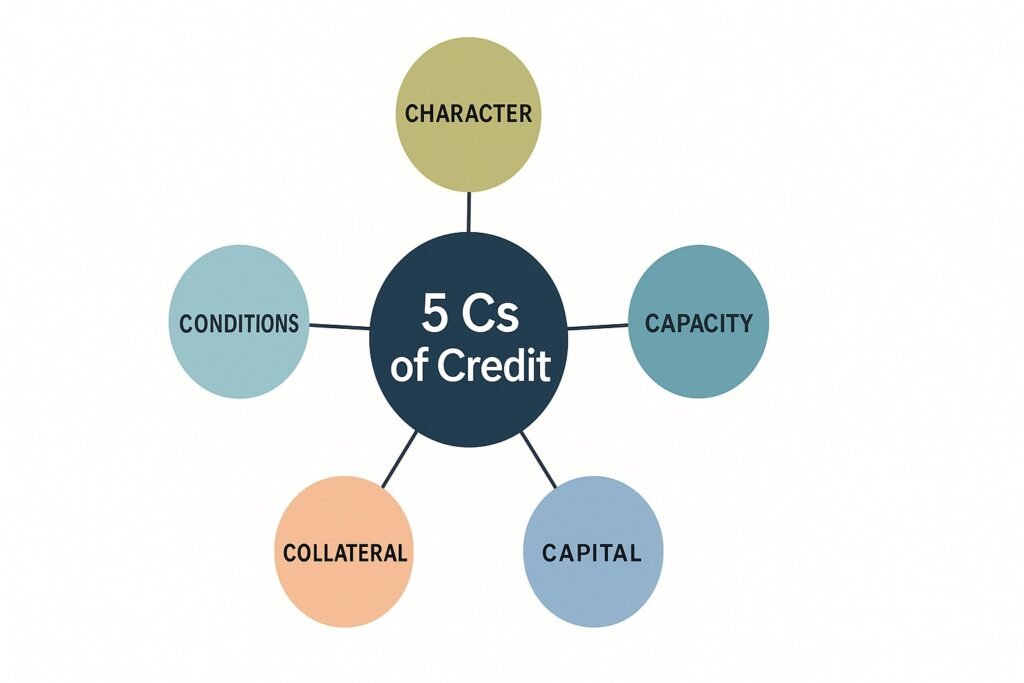

Lenders, investors, and credit analysts around the world rely on a classic framework to evaluate the financial trustworthiness of individuals and businesses: the 5 Cs of credit. This well-established method provides a comprehensive snapshot of a borrower’s financial health, risk level, and creditworthiness. Whether you’re applying for a business loan, personal credit, or preparing to offer credit as a lender, understanding these five essential pillars is crucial.

What is a Lender?

A lender is a person, financial institution, or organization that provides funds to a borrower with the expectation that the money will be repaid—often with interest—within an agreed time frame. Lenders can take various forms, including commercial banks, credit unions, online lending platforms, government agencies, or even private individuals.

Lenders play a central role in the financial ecosystem by facilitating access to capital. They assess risk based on frameworks like the 5 Cs of credit and set loan terms accordingly. In return for assuming risk, lenders earn interest or fees, which are essential for their business model. Responsible lending helps maintain the stability and integrity of financial markets while supporting personal and economic growth.

What is an Investor?

An investor is an individual or entity that allocates capital with the expectation of generating a financial return. Investors can be individuals saving for retirement, institutional players like pension funds and insurance companies, or venture capitalists backing startups. Unlike lenders, who are repaid with interest, investors often assume more risk in exchange for potential profits such as dividends, capital gains, or equity ownership.

Investors are vital to financial markets and business development. By providing capital, they fuel innovation, expansion, and job creation. Their involvement may be passive—such as buying stocks—or active, as in the case of angel investors or private equity firms that take a direct role in business strategy. Sound investment decisions rely on analyzing risk, returns, market conditions, and long-term value.

What is a Loan?

A loan is a financial arrangement in which one party, typically a lender, provides money to another party, the borrower, with the understanding that the funds will be repaid at a later date. Repayment usually includes interest, which serves as the cost of borrowing. Loans are governed by terms that specify the amount borrowed, the interest rate, the repayment schedule, and any additional conditions.

Loans can be used for a wide range of purposes—buying a home, financing education, starting or expanding a business, or covering personal expenses. They come in many forms, including secured loans backed by collateral and unsecured loans that rely on the borrower’s creditworthiness. Understanding how loans work is essential for managing debt wisely and making sound financial decisions.

The 5 Cs of Credit

The 5 Cs of credit are a foundational framework used by lenders and analysts to assess the creditworthiness of individuals and businesses. They include Character, Capacity, Capital, Collateral, and Conditions—each representing a critical aspect of a borrower’s financial profile. Understanding these elements can help you better navigate the lending process and improve your financial reputation. Whether you’re applying for a personal loan or seeking investment for your business, the 5 Cs offer a clear roadmap to building trust with financial institutions.

C1 = Character

The Foundation of Creditworthiness

Character refers to the borrower’s reputation, integrity, and reliability. Lenders assess character by reviewing an applicant’s credit history, professional background, references, and overall financial behavior. Credit scores, payment history, and existing debt obligations help paint a picture of how likely the borrower is to honor their commitments. Character can also be evaluated through interviews or business plans for entrepreneurs, especially when historical credit data is limited.

A borrower with a strong history of timely payments, responsible debt use, and transparent financial behavior will score high on this dimension. Trust, after all, is the currency that fuels lending.

C2 = Capacity

Evaluating the Ability to Repay

Capacity refers to the borrower’s ability to repay a loan using their income or cash flow. Lenders typically examine debt-to-income (DTI) ratios for individuals, or cash flow statements, income statements, and profit margins for businesses.

For individuals, a low DTI ratio indicates that a person is not overly burdened by existing debts, making them a more attractive candidate for new credit. For businesses, positive cash flow and consistent profitability demonstrate a healthy ability to service debt.

Capacity is often considered the most critical factor because even the most trustworthy borrower cannot repay a loan without adequate financial resources.

C3 = Capital

Skin in the Game

Capital refers to the amount of money the borrower has invested in their own venture or how much of their own assets are at stake in the deal. This metric is particularly vital for business loans. It represents the borrower’s commitment to the enterprise, indicating that they have “skin in the game.”

When a borrower has personally invested substantial capital, it suggests they are confident in the venture’s success and less likely to default. For lenders, this lowers the perceived risk. Capital can come in many forms: cash, equipment, inventory, or even intellectual property.

C4 = Collateral

Backing the Promise

Collateral is an asset pledged by the borrower to secure the loan. If the borrower fails to repay, the lender can seize the collateral to recover their funds. Common types of collateral include real estate, equipment, inventory, and receivables.

Collateral reduces risk for the lender and is particularly important in situations where other Cs are weaker. It acts as a safety net, ensuring that the lender has a recourse if the borrower defaults. The value and liquidity of the collateral are carefully assessed before a loan is approved.

C5 = Conditions

The Context of Lending

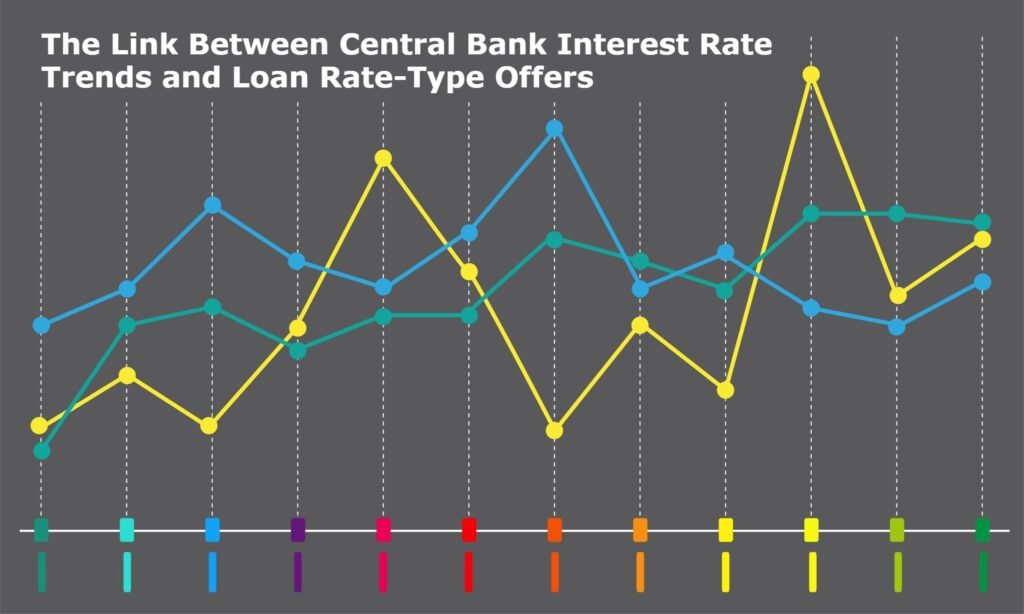

Conditions refer to the overall economic environment and the specific terms of the loan. This includes interest rates, loan purpose, industry trends, and broader economic indicators. For example, lenders may be more cautious during an economic downturn or in volatile industries.

Conditions also encompass the terms the borrower agrees to, such as loan amount, interest rate, repayment schedule, and covenants. These elements help lenders determine whether the risk is acceptable given the broader financial and industry context.

Why the 5 Cs Still Matter?

Despite advancements in data analytics and artificial intelligence in lending, the 5 Cs remain the cornerstone of traditional credit analysis. They offer a holistic view of a borrower’s financial profile, balancing qualitative and quantitative factors. Financial institutions continue to rely on this framework to make informed lending decisions that minimize risk and maximize responsible credit growth.

Master the 5 Cs for Financial Success!

Understanding and strengthening each of the 5 Cs can significantly improve an individual’s or business’s chances of securing financing. For borrowers, this means maintaining good credit habits, managing cash flow effectively, investing personal capital wisely, offering viable collateral, and staying attuned to economic trends.

We will continue to explore the nuances of credit analysis, finance, and lending practices. Be sure to check in with us every day for the latest insights. Leave a comment and let us know your thoughts or questions on the 5 Cs. We’re here to keep the conversation going.