|

Getting your Trinity Audio player ready...

|

Short on cash but own a vehicle? That’s where a registration loan enters the picture. Used primarily in states like Arizona, registration loans have become a niche but growing segment in the world of alternative financing. In this article, we’ll unpack what registration loans are, how they function, where they fit into the lending landscape, and the best practices for managing them wisely. Read to the end for our final thoughts and daily insights available only at Thinquer.

What Is a Registration Loan?

A registration loan is a type of short-term loan where a borrower uses their vehicle registration—not the car title—as collateral. Unlike a title loan, which requires you to own your vehicle outright, a registration loan is accessible even if your car is still under financing.

This option targets individuals who need quick access to cash but may not have strong credit or own their car outright. Lenders use your vehicle registration to assess eligibility, alongside factors like income and employment status.

A Brief History of Registration Loans

Registration loans emerged as a derivative of title lending in the early 2000s, particularly in U.S. states with flexible consumer lending laws like Arizona. While title loans required full vehicle ownership, registration loans provided a workaround for borrowers still financing their vehicles.

As the gig economy grew and access to traditional credit tightened for many working-class Americans, the demand for alternative financial products like registration loans increased. Over time, this niche lending option evolved through both in-store and online platforms, targeting individuals with limited credit histories or banking access. Despite regulatory scrutiny in some states, registration loans continue to fill a financial gap for short-term liquidity needs.

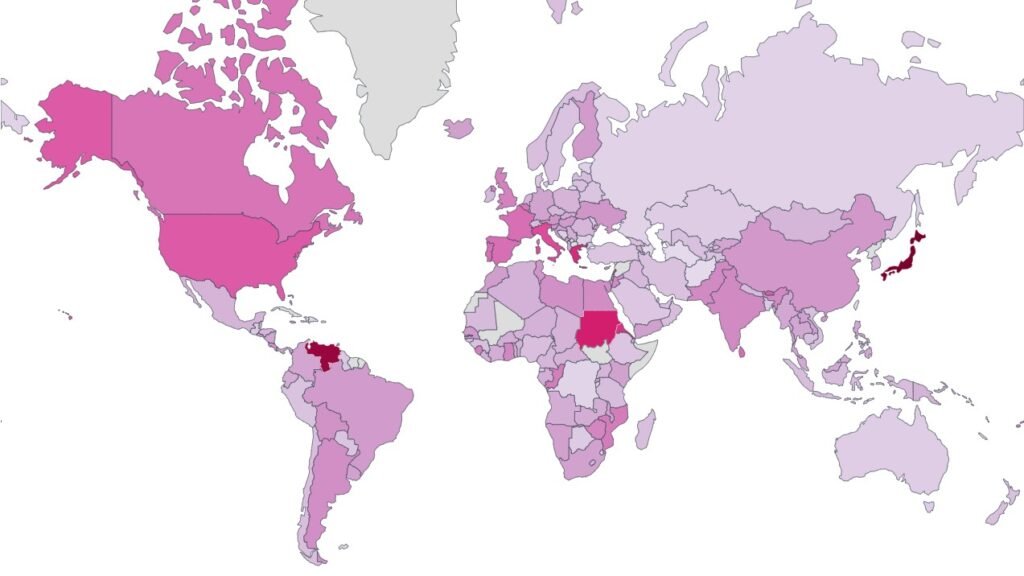

Where Are Registration Loans Available?

Registration loans are currently offered in a limited number of U.S. states, most notably Arizona, which serves as the primary hub for this type of lending.

Other states, such as New Mexico and Utah, have similar loan structures or hybrid models under alternative lending laws.

However, strict consumer protection regulations in states like California, New York, and Pennsylvania make registration loans either highly restricted or completely unavailable. Always check your state’s laws or consult a licensed lender to determine eligibility in your area.

How Do Registration Loans Work?

It starts with a simple application process, usually online or at a storefront. Here’s how it typically goes:

- Application: Submit proof of vehicle registration, ID, proof of income, and in some cases, proof of residence.

- Evaluation: The lender evaluates the value of the vehicle and determines your loan amount, generally a percentage of your car’s value.

- Loan Terms: The repayment terms are usually short (15 to 30 days), with high interest rates.

- Disbursement: Once approved, funds are disbursed the same day.

- Repayment: You repay the loan with interest, often in a lump sum.

If you default, the lender typically doesn’t repossess your vehicle, since they don’t hold the title. Instead, they may pursue collections or legal action.

Benefits of a Registration Loan

When used responsibly, a registration loan can serve as a short-term bridge in times of financial strain:

- Quick Access to Cash: Ideal for emergencies or unexpected expenses.

- No Title Required: You can qualify even if your car is still under loan.

- Credit-Flexible: Suitable for individuals with limited or poor credit history.

- Minimal Paperwork: The process is streamlined, often taking under an hour.

Risks and Challenges

These loans come with high interest rates and aggressive repayment schedules. If you’re unable to repay in full and on time, fees can spiral, putting you deeper in debt. Many borrowers may not fully understand the total cost of the loan until it’s too late.

Also, because the lender doesn’t hold the title, repossession is less common, but not impossible. Legal pressure or wage garnishment could follow non-payment.

Best Practices for Borrowers

If you’re considering a registration loan, here’s how to navigate it wisely:

- Understand the Full Cost: Request a complete amortization schedule before signing.

- Repay Early If Possible: Paying off early reduces the total interest paid.

- Compare Offers: Shop around to compare rates and terms.

- Avoid Rollovers: These extend the loan and significantly increase your cost.

- Use Sparingly: This should be a last resort, not a recurring financial tool.

Real-World Applications

People use registration loans in real-life scenarios like:

- Covering rent or utility bills before payday

- Emergency medical costs

- Car repairs

- Temporary income gaps

In communities with limited access to traditional banking or credit, these loans often become a necessary, albeit risky, option.

Proceed With Caution, Not Fear

Registration loans can provide quick relief, but they carry weighty financial implications. Think of them as a sharp tool—useful in a pinch, but dangerous if mishandled. If you’re in a tight financial spot and have no alternatives, proceed with caution, make a solid repayment plan, and always understand the terms in full.

Check back with us every day for fresh insights on finance, lending, and economic well-being. Got a question or personal experience with registration loans? Leave a comment below—we’d love to hear from you.

Stay informed, stay smart, only at Thinquer.

MEYJYTJY1347555MAYTRYR

MERTYHR1347555MARTHHDF