|

Getting your Trinity Audio player ready...

|

Exchange-Traded Funds (ETFs) have become one of the most dynamic and widely adopted financial instruments in modern markets. Their appeal extends from retail investors to institutional giants, offering liquidity, diversification, and cost efficiency. As global markets continue to evolve, so too does the role of ETFs in shaping investment strategies across sectors and geographies.

What is an ETF?

ETFs are investment funds that trade on stock exchanges, much like individual stocks. These funds track indices, commodities, bonds, or a mix of asset classes, providing investors with exposure to a broad market segment or a specific niche. Unlike mutual funds, ETFs can be bought and sold throughout the trading day, offering greater flexibility and transparency.

The value of an ETF is determined by its Net Asset Value (NAV), which is calculated by summing up the total market value of the fund’s assets and dividing by the number of outstanding shares. Additionally, the market price of an ETF can fluctuate due to supply and demand dynamics, occasionally leading to small premiums or discounts relative to NAV.

Who Invests in ETFs?

The accessibility and versatility of ETFs make them an attractive investment vehicle for a wide range of participants:

- Retail Investors: Individuals looking for low-cost diversification and ease of trading.

- Institutional Investors: Hedge funds, pension funds, and asset managers leverage ETFs for liquidity, hedging, and portfolio allocation.

- Day Traders: Active traders utilize ETFs to capitalize on short-term market movements.

- Long-Term Investors: Those building retirement portfolios appreciate ETFs for their cost-effectiveness and tax efficiency.

Global Market Trends in ETFs

The ETF industry has witnessed exponential growth over the past two decades, fueled by technological advancements and increased investor awareness. Several key trends are shaping the landscape:

- The Rise of Thematic ETFs: Investors are increasingly favoring ETFs that focus on emerging sectors like artificial intelligence, clean energy, and blockchain technology.

- ESG Investing: Environmental, Social, and Governance (ESG) ETFs have gained traction, reflecting a shift toward sustainable investing.

- Fixed-Income ETFs: Traditionally, bond investments were dominated by mutual funds, but ETFs have revolutionized fixed-income investing by providing liquidity and accessibility.

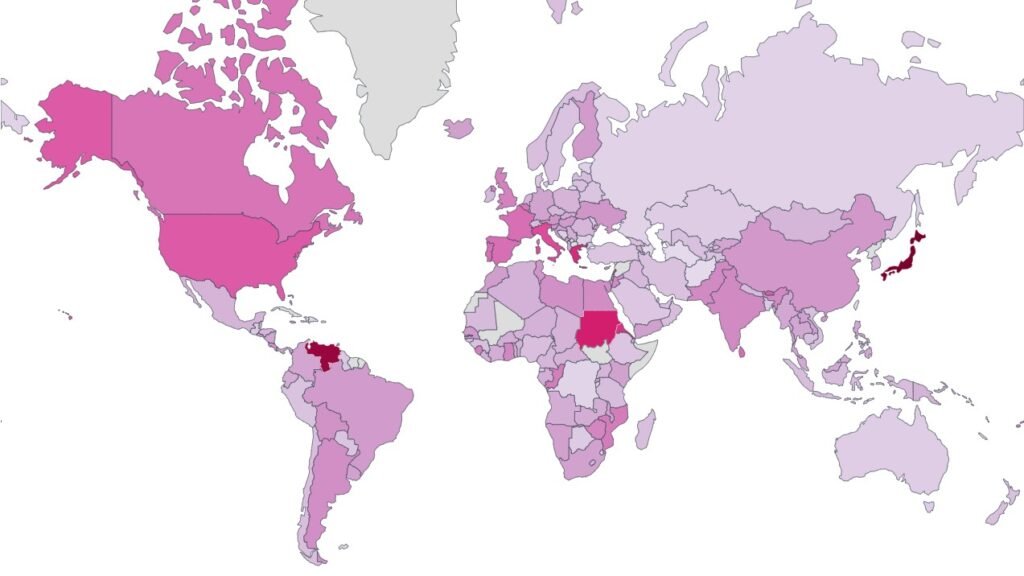

- International Expansion: ETFs are not confined to the U.S. market; regions such as Europe, Asia, and Latin America are witnessing rapid adoption.

- Smart Beta Strategies: Investors seeking enhanced returns are exploring factor-based ETFs that select stocks based on volatility, momentum, or fundamental attributes.

How to Invest in ETFs

Investing in ETFs is relatively straightforward, making them accessible to both novice and seasoned investors. Here’s how you can get started:

- Select a Brokerage Account: Choose an online brokerage platform that offers commission-free ETF trading.

- Identify Your Investment Goals: Whether you seek growth, income, or hedging, your investment objective will determine the type of ETFs suitable for you.

- Research ETF Options: Utilize resources like Morningstar, Bloomberg, or brokerage platforms to analyze ETF holdings, expense ratios, and historical performance.

- Execute Your Trade: ETFs trade like stocks, so you can place market, limit, or stop orders based on your trading strategy.

- Monitor and Rebalance: Periodically review your ETF portfolio to ensure it aligns with your financial goals and market conditions.

Where to Purchase ETFs

ETFs can be purchased through multiple channels, including:

- Online Brokerage Platforms: Fidelity, Vanguard, Charles Schwab, TD Ameritrade, and Robinhood.

- Traditional Financial Advisors: Full-service financial firms can guide ETF selection and portfolio construction.

- Robo-Advisors: Automated investment platforms like Betterment and Wealthfront use ETFs to construct diversified portfolios tailored to risk tolerance and financial goals.

Popular ETFs

Investors have a vast array of ETFs to choose from, each catering to different financial goals and market exposures. Here are some well-known ETFs across various categories:

- SPDR S&P 500 ETF Trust (SPY): One of the largest and most liquid ETFs, SPY tracks the performance of the S&P 500 index, making it a staple for broad market exposure.

- Vanguard Total Stock Market ETF (VTI): This ETF offers investors exposure to the entire U.S. stock market, including large-, mid-, and small-cap stocks.

- Invesco QQQ Trust (QQQ): Tracking the Nasdaq-100 Index, QQQ provides exposure to leading technology and growth stocks.

- iShares MSCI Emerging Markets ETF (EEM): This ETF allows investors to tap into emerging market equities, offering diversification beyond developed economies.

- ARK Innovation ETF (ARKK): Managed by ARK Invest, this actively managed fund focuses on disruptive innovation sectors like AI, genomics, and fintech.

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD): An ideal choice for fixed-income investors, LQD tracks a portfolio of high-quality corporate bonds.

The Future of ETFs

As global financial markets evolve, ETFs are poised for further innovation. Expect continued expansion into alternative asset classes such as private equity, real estate, and cryptocurrencies. Regulatory advancements and technological integration, including blockchain-based ETFs, may redefine how these investment vehicles operate in the coming years.

The ETF revolution shows no signs of slowing down. Whether you are a seasoned investor or just beginning your financial journey, ETFs offer an efficient and flexible path to building wealth.

We invite you to share your thoughts in the comments. What are your favorite ETF investment strategies? Check back with us daily as we continue exploring the latest trends and insights shaping the world of ETFs!