|

Getting your Trinity Audio player ready...

|

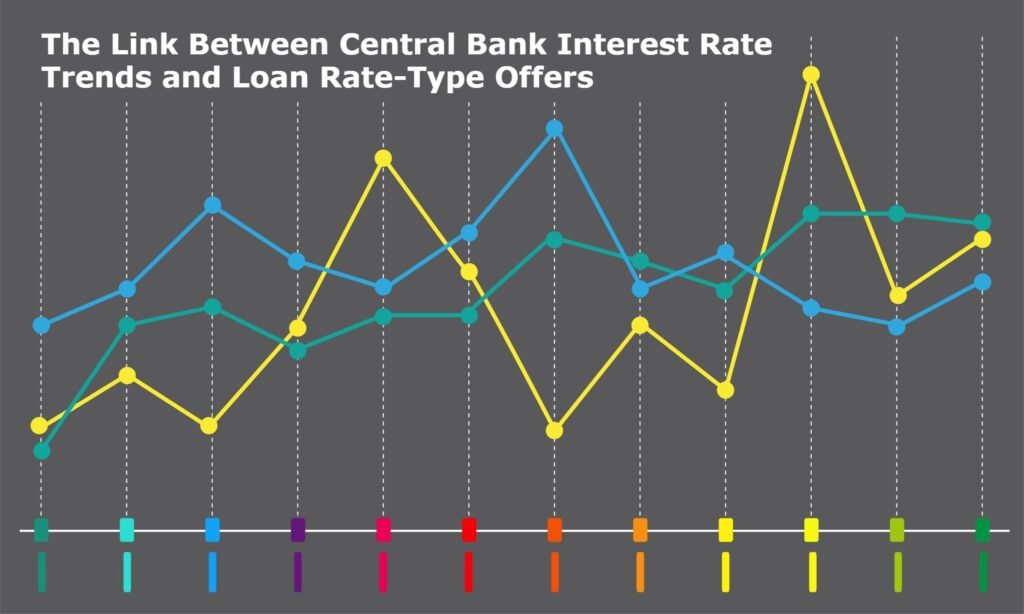

Amid shifting market conditions and economic trends, purchasing a home in the United Kingdom continues to represent a key life milestone for countless individuals and families. With the Bank of England’s interest rate holding steady and inflation slowing, the housing market in 2025 has been met with cautious optimism. But for buyers, one question reigns supreme: where can you find the best mortgage loan offer for your home purchase?

This report unpacks that question with a journalistic, story-telling lens and a sharp analytical eye. From understanding the nature of a mortgage to comparing top lenders, here’s everything you need to know about the best home acquisition loan offers in the UK today.

What Is a Loan?

A loan, at its core, is a financial agreement in which a lender provides a borrower with a sum of money under the agreement that it will be repaid, typically with interest, over a set period. Loans come in many forms, including personal, student, auto, and mortgage loans. Each serves a specific purpose, governed by terms such as repayment schedule, interest rate, collateral requirements, and penalties.

What Is a Home Acquisition Mortgage Loan?

A home acquisition mortgage loan is a specialized type of loan provided to individuals seeking to purchase residential property. Unlike a personal loan, a mortgage is secured against the property being purchased, which means the home itself serves as collateral. If the borrower fails to meet repayment terms, the lender has the legal right to repossess the property through foreclosure.

Mortgages can be fixed-rate (where the interest rate remains the same throughout the term), variable-rate (where the interest rate can fluctuate), or discounted-variable (where a discount is applied to the lender’s standard variable rate for a specific time).

Eligibility Criteria: Who Can Get a Mortgage in the UK?

Mortgage eligibility in the UK is influenced by several critical factors:

1. Credit History

Lenders assess your credit score to understand your financial reliability. Missed payments, defaults, or bankruptcies can significantly reduce your chances.

2. Employment and Income

Stable employment and verifiable income are key. Most lenders require proof of earnings for at least the past three to six months. Self-employed individuals may need to provide tax returns for two or more years.

3. Deposit Size

Most lenders require a deposit of at least 5% of the property’s value. However, larger deposits (10% to 40%) unlock better interest rates and mortgage terms.

4. Debt-to-Income Ratio

Lenders calculate your monthly debts relative to your gross monthly income. A lower ratio suggests you’re a lower-risk borrower.

5. Age and Residency

Applicants typically need to be 18 or older and either a UK resident or have the legal right to reside in the UK.

Best Mortgage Loan Offers in the UK (2025)

Here’s a detailed breakdown of the most competitive and accessible home acquisition mortgage loans available in the UK as of April 2025.

Lloyds Bank

Lloyds Bank offers several competitive mortgage options for buyers in 2025, with both short-term and medium-term fixed-rate choices to suit a range of borrowing needs.

2-Year Fixed-Rate Mortgage

Lloyds Bank offers a 2-year Fixed-Rate Mortgage aimed at buyers looking for short-term interest rate stability.

- Interest Rate: 3.86%

- Term: 2 years

- LTV: Up to 75%

- Fees: Approximately £999

- Special Notes: Ideal for buyers seeking short-term certainty in a potentially fluctuating market. Early repayment fees apply.

5-Year Fixed-Rate Mortgage

Lloyds Bank offers a 5-year Fixed-Rate Mortgage for borrowers seeking a balance between rate security and manageable loan terms.

- Interest Rate: 3.97%

- Term: 5 years

- LTV: Up to 75%

- Fees: Standard arrangement fees

- Suitable For: Homeowners aiming to lock in a low rate over a medium-term horizon.

Halifax

Halifax remains a major player in the UK mortgage sector, offering tailored options for first-time buyers and established homeowners alike.

2-Year Fixed-Rate Mortgage

Halifax offers a 2-year Fixed-Rate Mortgage suited for homebuyers seeking a short-term solution with fixed monthly payments.

- Interest Rate: 4.06%

- Term: 2 years

- LTV: 60%

- Fees: £1,099

- Special Feature: Often comes with incentives like free valuation or cashback for first-time buyers.

Barclays

Barclays offers a selection of innovative mortgage products tailored to meet modern buyers’ needs, including solutions that reward energy-efficient choices and support broader borrowing strategies.

Green Home 5-Year Fixed-Rate Mortgage

Barclays offers a Green Home 5-Year Fixed-Rate Mortgage designed to support eco-conscious buyers seeking sustainable property investments.

- Interest Rate: 3.96%

- Term: 5 years

- LTV: 60%

- Fees: £899

- Unique Feature: Designed for eco-friendly homes meeting specific energy performance criteria. Lower rates incentivize sustainability.

Mortgage Boost

- Concept: Allows applicants to add a family member or friend to increase borrowing power.

- Responsibilities: Co-applicant is liable for the loan but not added to the property deed.

- Best For: First-time buyers struggling to meet affordability criteria.

Santander

Santander offers a well-rounded lineup of mortgage options, including fixed-rate plans designed for buyers seeking long-term financial stability and predictability.

10-Year Fixed-Rate Mortgage

Santander offers a 10-year Fixed-Rate Mortgage designed for long-term homeownership stability and predictable payments.

- Interest Rate: 4.44%

- Term: 10 years

- LTV: 60%

- Fees: £999

- Perk: Long-term rate security with relatively low fees, ideal for families planning to stay in one home for a decade or longer.

First Direct

First Direct provides accessible and reliable mortgage solutions for homeowners seeking clarity and ease in the remortgaging process.

3-Year Fixed-Rate Mortgage

First Direct offers a 3-year Fixed-Rate Mortgage for remortgaging, providing a stable short-term refinancing option.

- Interest Rate: 4.09%

- Term: 3 years

- LTV: 60%

- Fees: £490

- Best Use: Remortgaging at competitive rates, especially beneficial for homeowners nearing the end of their current fixed-rate term.

Newbury Building Society

Newbury Building Society offers a range of flexible mortgage solutions for buyers who prefer adaptable lending terms with short-term benefits.

3-Year Discounted Variable Rate Mortgage

Newbury Building Society offers a 3-year discounted variable rate mortgage that provides a short-term lending option with a temporary interest reduction for eligible buyers.

- Interest Rate: 4.29% (2.11% discount from SVR)

- Term: 3 years

- LTV: 75%

- Fees: £850 total

- Good For: Buyers who anticipate rate drops or early repayments.

Loughborough Building Society

Loughborough Building Society provides a compelling mortgage option tailored to applicants with minor credit issues.

- LTV: Up to 95%

- Interest Rate: Typically higher than standard prime rates due to risk factors

- Fees: Varies by applicant profile and lender discretion

- Unique Advantage: Lenders like Loughborough Building Society are open to applicants with minor credit issues, including unresolved defaults on utility bills, without requiring extensive justifications

- Best Fit: Individuals who have faced past financial hurdles but are ready to take the next step in homeownership with lender flexibility on credit history

Choose the Right Mortgage for You!

Whether you are stepping onto the property ladder for the first time or looking to remortgage for better rates, 2025 offers a broad spectrum of opportunities in the UK mortgage market. Each product has been tailored for different needs—eco-conscious homeowners, buyers with small deposits, those with imperfect credit, or families seeking long-term stability.

Take time to evaluate your financial profile, your property goals, and your long-term plans. Consult a mortgage broker if you feel overwhelmed—they can help you find the right fit in this dynamic marketplace.

Leave us a comment with your thoughts, experiences, or questions about these mortgage products. Check back daily—we’ll continue covering new offers, policy changes, and insider advice to help you make the best possible decision for your home and your future.